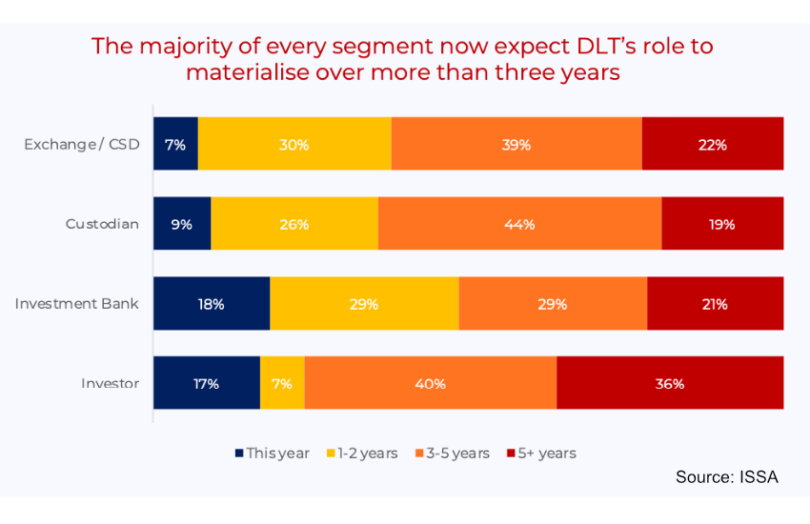

A survey on behalf of the International Security Services Association (ISSA) found that 39% of respondents have DLT deployments that are now in production, compared to 32% last year. Despite this, the expected timeframe for the benefits to materialize has become longer term. There’s a significant reduction in those predicting results this year and 61% envisage the full benefits achieved in three or more years.

Seventy percent of the 359 participants were custodian banks, investment banks, exchanges or CSDs and on average these groups saw DLT as 10% more important than last year. At Ledger Insights we’ve seen a significant increase in interest in DLT from asset managers, which was reflected in the survey with a rise of 45% for them and 40% for wealth managers. In contrast, the importance of DLT to insurance firms and pension funds dropped significantly by 50% or more. However, the small number of survey participants from all the groups with high percentage changes means one shouldn’t read too much into this.

Last year there was a 60:40 split in private versus public blockchain deployments. The share of usage of public blockchains continued to grow, reaching 44%. However the vast majority have application permissioning.

DLT, liquidity and other key drivers

One topic that received significant attention in the report was liquidity as a motivator. Investment banks were the most bullish, with 13% focused on liquidity, 9% of custodians and 6% of CSDs. One of the issues with DLT is the liquidity benefits might only be gleaned longer term. In order to achieve greater liquidity there needs to be a significant ecosystem and integrations with other platforms and legacy systems.

For example, if you look at bond issuance, many issuance platforms are standalone with limited integration. That means the digital bond is less liquid. In contrast, UBS issued a digitally native bond on SDX which was linked to the conventional SIX central securities depository (CSD), enabling investors to buy the bond without needing their custodian to integrate with blockchain. Hence, that integration significantly impacted the bond’s liquidity.

The biggest liquidity benefits expected of DLT are for cash and collateral. And it’s no surprise that Fnality, the tokenized settlement platform was a sponsor of the report.

Overall liquidity and increased mobility was a driver for only 9% of projects. Cost savings is the primary motivation behind 28% of projects, with learning and new revenues scoring 23% each.

For the reasons already mentioned, liquidity also ranked as the number three challenge in DLT projects. The biggest challenge is a lack of return on investment, cited by 21% of respondents, followed by competition from other non DLT projects for internal resources.