Masayoshi Son, the founder of SoftBank, raised a few eyebrows when he revealed talks to buy a minority stake in Swiss Re, in large part because Swiss Re operates outside SoftBank’s usual sweet spot. The reinsurer is the largest in the world, writing almost three times the premiums compared to Warren Buffet’s Berkshire Hathaway. So how is SoftBank’s interest in Swiss Re related to blockchain?

Blockchain is driving the automation of processes between insurers, brokers, and reinsurers, significantly reducing costs. The combination of blockchain, Artificial Intelligence (AI), the Internet of Things (IoT) and telematics will transform the insurance industry in the coming five to ten years, resulting in winners and losers.

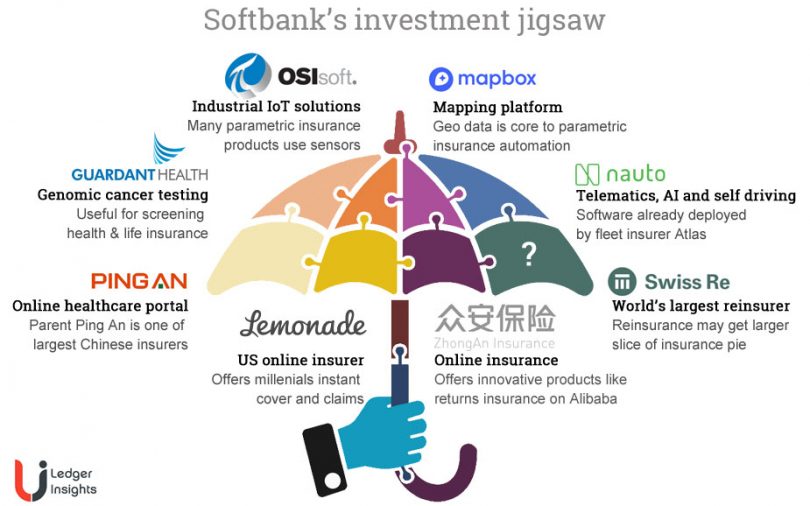

SoftBank has investments in several of these technologies as well as backing two direct insurers: the US based Lemonade and the innovative Chinese insurer, ZhongAn, which already uses blockchain technology.

Explosion in competition for primary insurers

The concept of an automated virtual insurer was first floated during the dotcom boom of the late 90s, but that level of automation is only happening now with distributed ledgers as a key enabler. In addition, AI is now powering credible insurance adviser bots.

An entire insurance business can be stored on a distributed ledger and, in some cases, the claims process could be completely automated. In other instances, the process could be outsourced using a blockchain.

That translates to lower barriers to entry and increased competition. Airlines currently re-sell insurance, but with these changes, they may opt to hire a handful of people and a part-time actuary to run their own insurance subsidiary. Insurance will become plug-n-play everywhere.

Incumbent insurers have neglected their customers for years. So new insurers, like Lemonade, are stepping in to provide a better service, passing on savings to customers, and offering features like instant payouts on claims.

These new insurers force downward pressure on premiums because clients want instantaneous free policy adjustments, the ability to switch their coverage on and off, and the ability to choose only the subset of insurance they need.

So despite the gains in terms of efficiency, there could be significant pressure on primary insurers in the coming years.

Demand for reinsurance will rise

There are potential big wins for reinsurers:

- All these new insurers still need to cover their downside. Their risk appetite will be lower than incumbent insurers, so they’ll pass on more risk and money to reinsurers.

- AI means that the big reinsurers can extract meaningful insights from their treasure trove of data.

- Blockchain will result in administrative savings of up to 30%.

There is one caveat to all this, however. Reinsurers will also face more competition. To date catastrophe bonds have dominated Insurance Linked Securities (ILS), which is fund management involving reinsurance risks rather than stocks.

But ILS are starting to cover all reinsurance scenarios beyond catastrophe risks, which could take business away from reinsurers. As claims systems become blockchain based, ILS fund managers can package together the reinsurance risks of many insurers. Data coming from the claims blockchain can provide real-time claims information to ILS investors. It’s conceivable that SoftBank could take an interest in ILS as well.

It should be no surprise that SoftBank is keen to gain a significant foothold in a sector which is starting to be disrupted by technology, though Swiss Re emphasized that the talks were at a very early stage.