This week the Reserve Bank of India released figures showing a tiny balance for its wholesale central bank digital currency (wholesale CBDC). At the end of March 2024 the figure was just 800,000 rupees, equivalent to less than $10,000. That’s down from Rupee 107 million ($1.3m) the previous March.

In November 2022, India started piloting its first wholesale CBDC use case to settle secondary market transactions for government bonds. One unusual aspect was this reportedly used an account based wholesale CBDC whereas they are typically token based. By February activity had already trailed off and the central bank said it was planning numerous other use cases. It also wanted to try different technology setups.

The same nine banks were involved in a second use case for interbank lending in the call money markets. It started in October 2023, but little further news has been released. Subsequently, there was an unconfirmed report that India was planning to go live with its wholesale CBDC in January 2024. So far that has not transpired. In April the central bank held meetings with the payment sector, aiming to address the lack of wholesale and consumer interest.

There are alternative explanations for the low wholesale CBDC balances apart from a lack of interest. For example, many banks may choose to convert any CBDC holdings to central bank reserves to earn interest. Or the central bank may have decided to automatically convert them at the end of the day.

Retail digital rupee

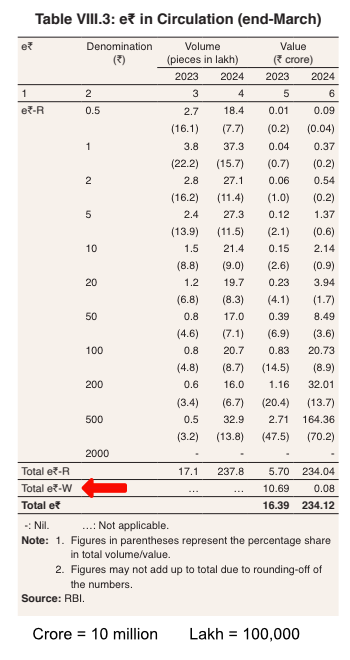

Regarding the retail digital rupee, in the year ending 31 March 2024, the balance increased from Rupee 57 million ($680,000) to Rupee 2.34 billion ($28m). During a press conference in April, Deputy Governor T Rabi Sankar said there were 4.6 million consumers onboarded and 400,000 merchants.

India’s retail CBDC app makes it seem cash-like, so users choose which denominations they want. Similarly they receive change from transactions in various digital notes. That’s why the table below shows which notes are most used. Seventy percent of the value is held in the highest denomination 500 Rupee ($6) digital note.

Meanwhile, although there are potential financial inclusion applications for India’s CBDC, both the Treasury and central bank have eyed cross border remittances as the potential killer app from the start.