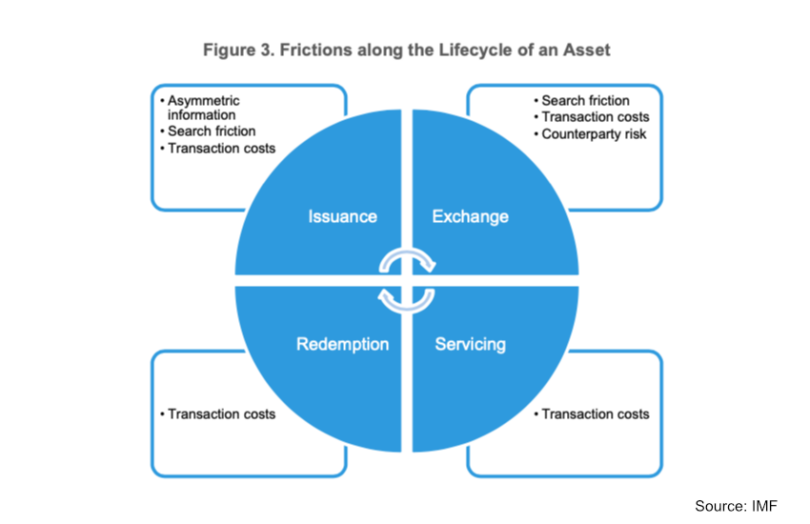

The International Monetary Fund (IMF) published a paper on Tokenization and Financial Market Inefficiencies. As per the graphic, it identifies inefficiencies at every stage of an asset’s lifecycle which can be addressed by tokenization. The ability to combine a shared ledger and programmability in the same system helps to cut costs, frictions and risks as well as improve transparency. While the authors spend almost as much time on the benefits as the risks, given this is an IMF paper, we will look at the highlighted risks because that could inform future regulations.

What follows is not a summary. It covers a subset of the issues raised, with examples and opinions added.

The authors note that the increased interlinking between market players is what enables many of the cost and friction reductions, but can at the same time elevate risks.

While some of the risks that the IMF identifies are quite serious ones, most of them either can be influenced by regulators or are an acceleration of trends that are already happening.

Tokenization and leverage

For example, the authors are concerned that tokenization could encourage greater leverage, but at the same time they acknowledge that financial institutions already have strict requirements imposed on their balance sheets. One of the few points we were not convinced by was that the reduction in bond issuance costs might encourage significantly more leverage at the institutional level. On the other hand, smart contracts enabling rehypothecation in an automated manner could increase leverage.

Tokenization’s impact on bank funding

Bank funding could be impacted by tokenization if banks have to switch from retail deposits to wholesale funding. The latter is also trickier to maintain during a crisis. The paper didn’t go into detail, but on public blockchains it’s already possible to quickly switch between non interest bearing stablecoins and interest bearing assets, so tokenization will expand that to the mainstream. However, AI is also likely to reduce switching frictions and increase speed, so this is a trend that is inevitable. It’s simply a matter of how long it takes. We’d observe one of the bigger risks here would be the launch of a retail CBDC, which is not mentioned by the authors.

The potential for tokenization to increase trading speed and interconnectedness would impact risks, especially in a crisis. Flash crashes have already happened without tokenization, so some of the solutions already implemented might be capable of being adapted.

Composability

Composability is a key benefit of tokenization – the ability to build assets out of others in a lego-like fashion. However, this could prove tricky from a risk perspective. One example was the failure of Silicon Valley Bank. This resulted in the USDC losing its peg. But so did the DAI stablecoin, which used the USDC stablecoin as part of its reserves. Hence, with composability, a run on one asset can trigger the same for other related assets.

While we’ve mostly covered the institutional risks, the paper also delves into the risks for retail investors. In the crypto sector, composability is already being used to create somewhat complex assets that even some moderately sophisticated investors struggle with, never mind consumers. We’d note that many assets look somewhat similar, but under the hood are often quite different.

Legal structures

That’s especially when it comes to legal structures, which is a point not particularly made in the paper. For example, there are a number of public blockchain money market funds. Not only do the assets in the funds differ significantly, but so do the legal structures. Blackrock’s BUIDL and Hashnote’s USYC are both offshore structures, whereas Franklin Templeton’s is U.S.-based. Likewise, the USDC stablecoin does not use a trust structure, whereas the PayPal USD does. Most consumers would be oblivious.

There are the more obvious risks of retail investors not appreciating that higher offered returns inevitably come with higher risks. Knowledge tests, qualifications and exposure limits are already used today for various types of assets.

The IMF sees bigger risks for retail investors on public blockchains because of fraud and illicit activities. In our view, if access is primarily via regulated players, that may not be a big risk, because the regulated entity invariably has some level of control, including the ability to revert a fraudulent transaction. That applies to transfer agents for funds. Or in the case of a regulated exchange and settlement venue such as Germany’s 21X, there are similar safeguards in place.

While the paper did not explore regulation, it concluded that “Regulations play a key role in addressing financial market inefficiencies, and they might need to be adapted to both harness the benefits and mitigate the adverse effects of tokenization.”