Research firm International Data Corporation (IDC) has scaled back its forecast for global blockchain spending by 7.7% and now anticipates 57.7% growth over 2019 to reach nearly $4.3 billion in 2020. IDC reduced its forecast for 2023 and now expects spending to hit $14.4 billion from the pre-COVID-19 estimate of nearly $16 billion.

The research firm cites COVID-19 effects on businesses that have cut down IT spending amid weak economic prospects. It said blockchain spending would decline across all sectors, but some more than others.

Regional impact

While worldwide the blockchain spending forecast was cut by 7.7%, Asia Pacific will see a reduction of 6%. Two months ago, IDC said European blockchain spending growth would decline by 8% compared to previously.

The Asia Pacific region contributes around 19.3% to global blockchain spend and is dominated by three use cases — cross-border payments & settlements, trade finance & post-trade/transaction settlements, and regulatory compliance.

Blockchain enables businesses to efficiently monitor supply chains, track and trace goods, and maintain an auditable record of product movement. IDC says companies that adopted blockchain before the pandemic fared better than others.

“The technology has helped enterprises across many industries to overcome the challenges from managing supply chains, medical data verifications, and tracking insurance claims in the Asia/Pacific region where the adoption is still in its nascent stage,” said Ritika Srivastava, Associate Market Analyst at IDC Asia/Pacific.

Meanwhile, the U.S. will lead in blockchain spending in 2020, despite a 6% reduction to previous forecasts.

Sector impact

IDC says hospitality, tourism, transportation, and construction industries will see a spending decline of 9.5% or more. The financial sector, which has been at the forefront of adopting blockchain, will see a moderate reduction in spending. However, banking, securities, and investment services, and insurance industries are still expected to invest over $1.6 billion in 2020.

As supply chains reel under pressure, IDC expects the manufacturing and resources sector to see the fastest growth in blockchain spending with a CAGR of 60.5% over the 2018-23 period. This is followed by the distribution and services sector, which will grow at a CAGR of 58.7%.

Blockchain use case impact

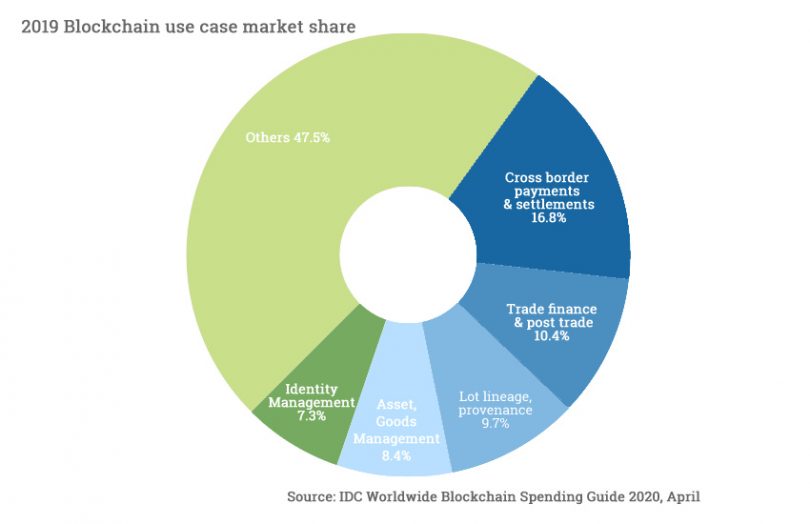

Cross-border payment and settlements, product provenance, and others will take the top spot for blockchain investment in 2020, accounting for 16.8%. Manufacturing and distribution companies will focus on the provenance of goods, while decentralized identity will receive significant interest from banking, government, and healthcare entities.

“This is due largely to the unique characteristics of blockchain technology such as decentralization, transparency, and redundancy,” said James Wester, Research Director for Worldwide Blockchain Strategies.

“These are traits that many existing technology approaches in supply chains, healthcare, and financial services lack today – it is the lack of these features that have exposed issues in the way we currently do things such as track foods or distribute pharmaceuticals.”

Other recent IDC blockchain forecasts and surveys include:

- IDC European enterprise blockchain spending forecast (May 2020)

- IDC China enterprise blockchain spending forecast (Nov 2019)

- IDC enterprise blockchain spending forecast (Aug 2019)

- IDC: 44% of European health providers never heard of blockchain (June 2019)

- Thales, IDC research reveals extensive US government blockchain adoption (May 2019)

- IDC: Trade finance took biggest slice of 2018 APAC blockchain spending (April 2019)

- IDC forecasts rapid enterprise blockchain spending growth (March 2019)

- IDC predicts huge blockchain impact on digital transformation by 2021 (Nov 2018)

- IDC blockchain spending predictions overshadowed by startups (July 2018)