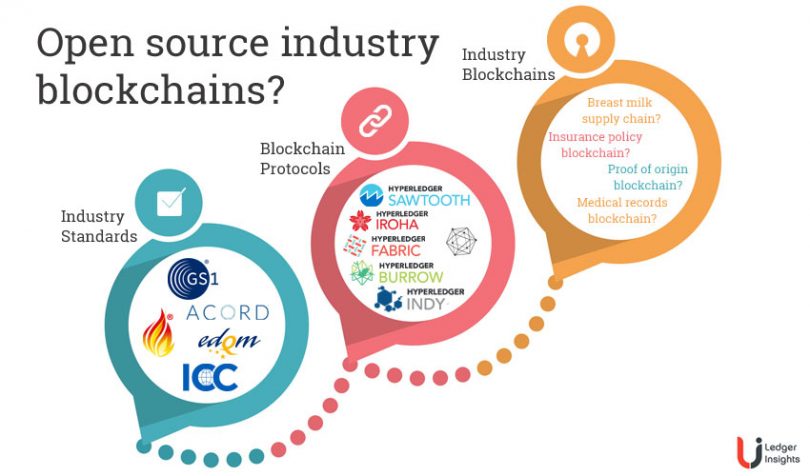

Hyperledger is the umbrella body for ten open source blockchain projects, all of which are cross-industry. So far, that is. Ledger Insights spoke to Hyperledger Executive Director, Brian Behlendorf, and explored the likelihood of industry-specific open source blockchains. Open source could significantly impact the governance of industry consortia and increase the pace of innovation.

For the health sector, there’s potential for an open source Electronic Health Record project. For supply chain it could be a provenance ledger for diamonds or luxury goods. Or a blockchain for bills of lading. In the case of insurance perhaps a policy ledger.

Behlendorf says his read is there’s an appetite for open-source industry blockchains and he’s playing “the role of a weatherman.” He’s not the decision maker, nor is his boss at the parent Linux Foundation. Hyperledger is community driven. It has 700 contributors who nominate an eleven-person technical steering committee that makes these kinds of decisions.

In fact, Hyperledger is already exploring an industry-specific blockchain. Before becoming projects, ideas are first tested out in Hyperledger Labs. Just over a week ago, the Health industry working group initiated a new Lab project. The breast milk industry faces challenges with provenance tracking and fraud. So the new project plans to create code to demonstrate how to address the problems.

Why it matters: Risk versus Reward

Behlendorf has a deep track record in open source. He was the primary developer of the Apache Web server, he launched the Apache Software Foundation, and he’s on the board of the Mozilla Foundation.

The personal appeal of open source software for him is illuminating: “I love the idea of freedom at a level of being able to say: you and I if we know that we can work together, but if our working together doesn’t turn out [well], I haven’t lost my investment. Because I can take that software and go in my own direction.”

So open sourcing the software reduces the risk. And it potentially creates a Darwinian race for the best solution.

This is not Behlendorf’s take: But consider the many industry blockchain alliances where the consortia initiators own the intellectual property even if they license it to the rest of the community.

What if the consortium becomes dysfunctional for whatever reason? The technology might be locked in with the owners. If instead some of the software were open-sourced that risk would be mitigated.

It doesn’t necessitate the alliance’s entire technology being open sourced. Instead, it could be the foundational aspects, like electronic health records or insurance policies.

That’s not a big leap because in creating consortia the participants already acknowledge that part of the industry’s software infrastructure is not a competitive differentiator.

The software stack: Commoditization and standarization

Software mimics business as a whole. Some offerings in the early stages are innovative and competitive differentiators. As everyone catches up those same features are later viewed as generic or commoditized. In software, developers move ‘up the stack’ in search of higher margins.

“If you’re building a proprietary app on top of an open-source series of layers, you’re always watching what that horizon is,” said Behlendorf. “Because you don’t want to wake up one morning and discover somebody has open sourced something that now you have to be competing against. Competing against free is bad. Competing against free and collaborated upon by all of your competitors is even worse.”

Industry standards are lagging indicators of commoditization. Most sectors have standards bodies such as GS1 for supply chain and ACORD for insurance. Standards tend to apply to common data, documents, and transactions which lend themselves to blockchain solutions.

Behlendorf commented: “I think we want to be careful not to go all the way up the stack to end-user applications too quickly. Partly because in those cases the majority of the code will actually have nothing to do with distributed ledgers and smart contracts. They [the DLTs] are kind of treated as a data source or as a transaction target. Most of the heavy lift will be in crafting an end-user interface.”

Impact on innovation

There are parallels between an industry component blockchain that’s permissioned yet open source, and public blockchains, particularly when it comes to innovation.

Last year CryptoKitties, the Ethereum virtual game, was so popular that it almost brought the network to its knees. In the game, players buy and collect virtual cats, and the smart contract enables the cats to breed. So far they’ve made more than 2.8m transactions with Crypto Kitty smart contracts.

A group of three people thought CryptoKitties were cool but decided the cats needed hats. Hence they created KittyHats so players can buy a hat to add to their CryptoKitty.

Dieter Shirley from CryptoKitties spoke about it at Token Summit: “Because of the nature of blockchain, they could build their entire product on top of CryptoKitties that allowed them to sell tokens independent of us, on their own website. The user owns the cat. But the cat owns the hat. If you sell your cat, the hat goes with it.”

“It was this amazing win-win situation where this team was able to create a product which they could profit off of by selling these tokens. Our users who have cats are creating value for themselves because dressing up cats is hilariously fun. And guess what, they made our ecosystem stronger.”

Translate that to industry blockchains and imagine the potential to build applications on top of electronic health records which are shared appropriately.

Impact on governance

With open source the threat of a breakaway group has a positive impact on governance by encouraging collaboration.

Additionally, there’s the potential to directly influence the governance of consortia by creating greater democracy as well as transparency in the governance. For example, Hyperledger’s Technical Steering Committee meetings are recorded and published. Why shouldn’t this be the case for industries?

Counter argument

There are plenty of arguments against open sourcing industry solutions.

For example, why shouldn’t those that make the initial investment reap the benefit? The answer depends on the players. If companies have particular skills or advantages that will help with solutions further up the stack, they can reap more significant rewards later. IBM’s contribution of Fabric to Hyperledger is a good example.

Another argument is that certain companies will always be takers and always be predatory. While that’s true, it’s clear that blockchain business relies on ecosystems which require collaboration. Perhaps the future belongs to those that play well with others.

Conclusion

One of the biggest concerns for those using the product of an existing industry consortium is the fear that early participants have an advantage. By increasing openness, there’s a greater likelihood of broader involvement. And it makes the ecosystem stronger.

In Behlendorf’s words: “I think Metcalfe’s law still applies where the larger networks are more valuable.”