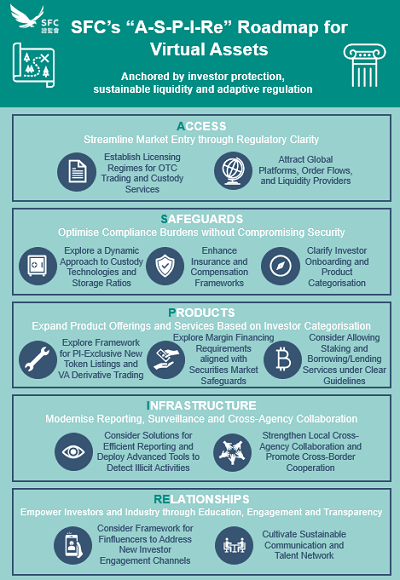

Today Hong Kong’s Securities and Futures Commission (SFC) published a 12 point ASPIRe roadmap for the territory to become a global digital asset hub. Until October last year, it had licensed two cryptocurrency exchanges. That figure rose to ten yesterday with the licensing of Bullish, the exchange founded by Block.one and backed by Peter Thiel.

Top of the SFC’s priority list is to introduce licensing regimes for over the counter (OTC) ‘virtual asset’ marketplaces as well as virtual asset custodians. While it wants to ensure better compliance and enhance consumer protection, it is willing to lean into the more innovative aspects of web3 that are sometimes considered risky.

Currently the following activities are not allowed in Hong Kong, even for licensed exchanges: New token issuance, margin trading, derivatives, staking, and borrowing/lending. The SFC is willing to explore each of these, but some will be restricted to professional investors, such as derivatives and borrowing/lending.

“Adhering to the core principles of investor protection, sustainable liquidity and adaptive regulation, the roadmap in itself is a calibrated response to emerging VA market challenges and thus helps future-proof our ecosystem,” said Dr Eric Yip, the SFC’s Executive Director of Intermediaries.

“The roadmap is not a final destination but a living blueprint, one that invites collective efforts to advance Hong Kong’s vision as a global hub where innovation thrives within guardrails.”

If you’re a regular Ledger Insights reader, there’s likely a feature you’d like to see us add, or something that bothers you that we can fix. We want you’re feedback, good or bad! Please take a minute or two to answer this short survey.