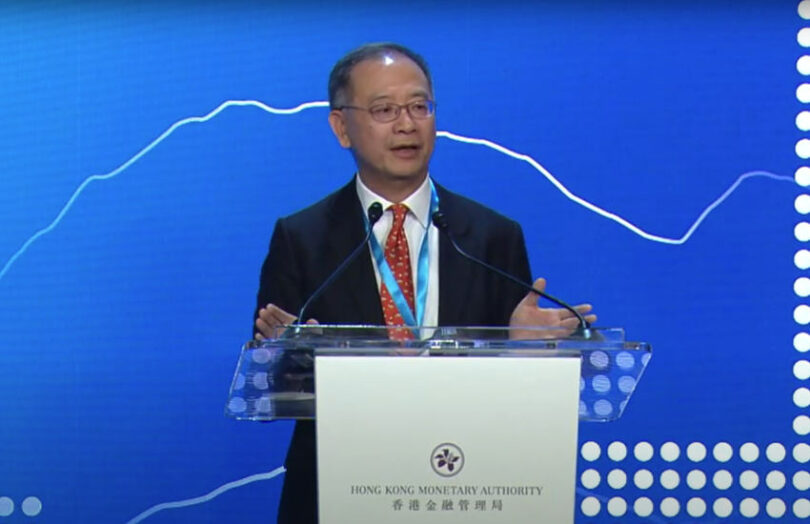

During a speech yesterday Eddie Yue, CEO of the Hong Kong Monetary Authority (HKMA), discussed the future of digital money in the tokenization era. He touched on retail central bank digital currency (CBDC), stablecoins, tokenized deposits and wholesale CBDC. Its work on a retail CBDC is quite advanced, but Mr. Yue was nonetheless cautious.

“It remains to be seen whether the benefits of its issuance would outweigh the risks,” he said, outlining a need to assess the impact on the broader financial system. That likely means global concerns about the impact on bank deposits. He added, “We will continue to take a use-case driven approach in thinking about whether and when to introduce a retail CBDC.”

Last month the central bank opened applications for participants in its second phase of retail CBDC trials. During 2022 as part of Project Aurum it also explored a CBDC-backed stablecoin. This mirrored the way Hong Kong authorized three banks to issue physical bank notes. Hence, these were not typical stablecoins but what Mr. Yue described as ‘close cousins’ of CBDC.

On the topic of stablecoins, in his speech he mentioned the recent completion of stablecoin consultations, with the central bank launching a stablecoin sandbox last month.

Additionally, it unveiled Project Ensemble, a wholesale CBDC project to explore interbank settlement with tokenized central bank money. This will also support experimentation with tokenized deposits. “Whilst the full potential of tokenized deposits has yet to be explored, we have observed strong interest in this area,” said Mr. Yue.

mBridge cross border CDBC

Mr. Yue only mentioned the mBridge project in passing. That’s the cross border CBDC project with the BIS and the central banks of China, Thailand and the UAE. Additionally, more than 20 central banks are observers. It aims to reduce the time and cost of cross border payments.

The HKMA CEO described it as “one of the more advanced explorations of a multi-CBDC platform globally.” However, he didn’t touch on the potential launch timing after previously saying minimum viable product trials would start during the first half of this year. He said trade settlement trials would run this month during a separate talk at the end of March.