Hermes, the luxury company with a market capitalization of €142 billion ($162bn), has sued NFT creator Mason Rothschild, who designed the MetaBirkins NFTs. The New York lawsuit was filed last Friday alleging trademark infringement. On its face, MetaBirkins appears to be a straightforward trademark infringement, but we’re not so sure. If brands want to protect marks in the virtual world, ideally those marks should cover digital or electronic objects.

There’s more on the line than just the MetaBirkins NFTs. A recent report from Morgan Stanley estimated that by 2030 metaverse gaming and NFTs could increase the sector’s sales by 10% and enhance profits by 25%. So luxury brands will want to make sure they can protect their marks.

The lawsuit accuses the NFT creator of being “a digital speculator who is seeking to get rich quick by appropriating the brand METABIRKINS for use in creating, marketing, selling, and facilitating the exchange of digital assets known as non-fungible tokens (NFTs).” It continues that the “METABIRKINS brand simply rips off Hermès’ famous BIRKIN trademark by adding the generic prefix ‘meta’ to the famous trademark BIRKIN”.

Hermes has a long list of trademarks, and the NFTs most certainly show Birkin-like bags. The designer created 100 digital faux fur handbags as a “tribute to Hermes’ most famous handbag.” Some of the digital assets have re-sold for more than $40,000 and according to NFT marketplace Rarible, the collection has turned over more than $1.2 million.

To quantify Mr. Rothschild’s earnings, he initially sold the 100 bags in December 2021 for around $322 each, receiving $32,200. Plus, he gets 7.5% of the re-sales of $1.2 million, which is $90,000, giving a total earned of just over $120,000. But of course, it’s all about future earnings.

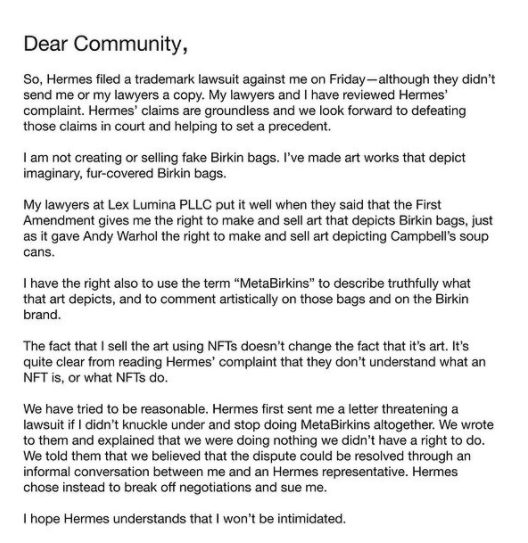

Will Rothschild fold in the face of the lawsuit? No, he intends to stand his ground. And he’s pretty belligerent.

We see three areas where Hermes’ case might be weak, and a couple where it’s weak on the MetaBirkins side.

Are Hermes’ trademarks valid for digital?

Hermes is claiming infringement of both Hermes and Birkin trademarks.

In mid December, Hermes sent a cease and desist letter to Rothschild and persuaded OpenSea to take down the NFT listings (so Rothschild just moved to other marketplaces). Attached to the letter was a long list of trademarks, with the term ‘Hermes’ covering every object under the sun. Well, ALMOST everything under the sun that’s physical. But the digital side, not so much.

For the Hermes trademark, one class was canceled relating to electronic “images, sound and data concerning wearing apparel, shoes, handbags, watches,” and more. The cancellation refers to a lack of evidence of continuing use.

The Birkin trademark is a lot narrower, relating to handbags. Again it appears to be physical handbags. However, it does include the handbag design, which could very well be an issue for Rothschild.

Even if the trademark covers digital goods, the artist makes a separate assertion.

Rothschild claims first amendment right for art

In his response to the lawsuit, Rothschild says, “the first Amendment gives me the right to make and sell art that depicts Birkin bags, just as it gave Andy Warhol the right to make and sell art depicting Campbell cans.” And Rothschild says he won’t be intimidated.

Do buyers believe they are buying Hermes art?

Moving on to a third potential weakness is the question of whether or not buyers think they are buying a Hermes bag. The first MetaBirkins was sold in early December, and we checked an archived version of the website, which contained a disclaimer that MetaBirkins is not linked to Hermes.

We suspect most of the buyers will be aware of the lack of association with Hermes. It was pretty clear in a Yahoo News interview that Rothschild was an artist. While NFT ownership is pseudonymous, many NFT collectors buy ETH domain names and use them for their NFT wallets. Several of the MetaBirkins owners have ETH domains so they would be contactable.

Logically, if Hermes sold a relatively small number of NFTs, they would have pulled in significantly more money. The initial MetaBirkins sales yielded $32,200. In September, Dolce & Gabbana sold nine NFTs for $5.65 milllion.

However, on the flip side, the marketplaces where the NFTs are sold don’t carry disclaimers. Before the OpenSea listing was shut down, it mentioned that MetaBirkins was a tribute to Hermes, although the statement should have been more explicit about not being associated.

Also a few people might be aware of Birkin, but not that it’s a Hermes brand. Depending on your perspective, the artists name might be fortunate or unfortunate. One might expect the name Mason Rothschild is a play on ‘Maison’ Rothschild, but it appears to be the designer’s real name.

MetaBirkins are getting counterfeited!

There’s not a little irony in the fact that MetaBirkins is having a problem with counterfeits. So while NFTs are easy to trace, fraudsters often create tokens with similar names and rip off art to trick people into paying for fake NFTs.

In the lawsuit, Hermes argues that the existence of fake or counterfeit MetaBirkins NFTs means that Rothschild is asserting a trademark over the term MetaBirkins which is problematic.

We’ll have to see how this plays out in court, but brands should be on notice that they need to have adequate trademarks that also cover the digital realm. It’s no coincidence that Walmart recently filed trademarks over everything related to NFTs, cryptocurrencies, and 3D shopping in the metaverse.

The author is not a lawyer, and this is not legal advice.