Today Giesecke+Devrient (G+D) announced a partnership with the Banque Centrale de Mauritanie to design and explore a potential central bank digital currency (CBDC).

“The digital Ouguiya is part of the digital transformation agenda for the entire country and is of critical importance for economic and social progress,” said Wolfram Seidemann, CEO of G+D Currency Technology. He added that G+D has a 50 year relationship with the central bank.

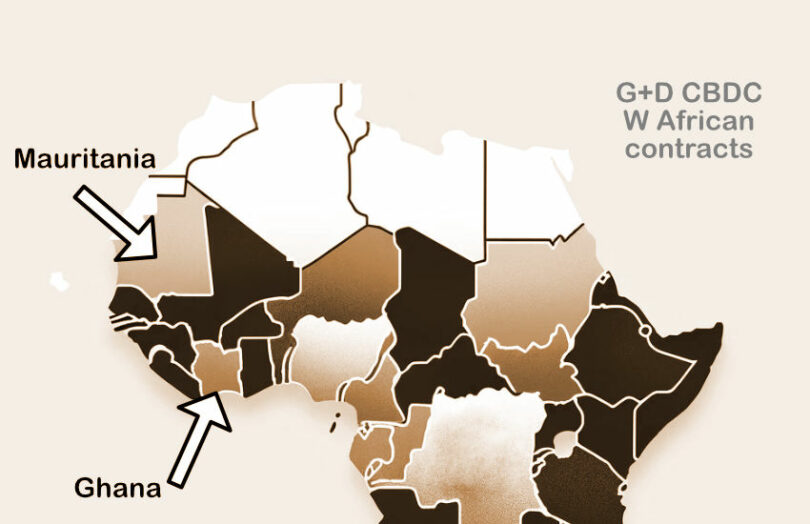

G+D has formally participated in at least three other CBDC projects with its G+D Filia CBDC platform. They include Thailand which recently reported its results, an offline solution as one of the pilot projects in Brazil, and fellow West African country Ghana.

However, Ghana and Mauritania are fundamentally different scenarios. Where Ghana has a population of more than 33 million, Mauritania’s is less than five million.

More importantly, Mauritania has a very low rate of financial inclusion. Just 23% of the population aged 15 or older has some kind of financial account. That compares to Ghana, where the rate is more than 68%, largely due to mobile money services introduced in 2009. Despite this, Ghana’s per capita income is only about 7% higher than Mauritania, which has a GDP of $2,065 per capita.