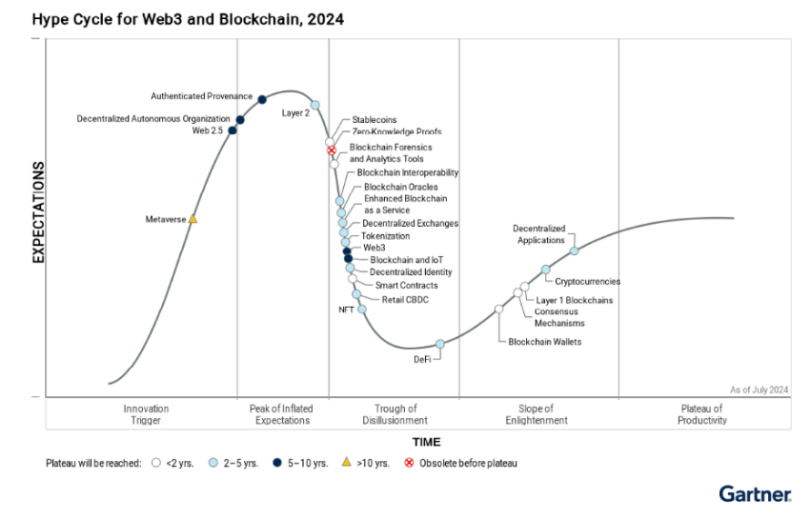

In late July, Gartner published its 2024 version of the hype cycle for Blockchain and Web3. One of the most notable aspects is which technologies it believes will reach the plateau of productivity in the next two years. These include blockchain wallets, smart contracts and stablecoins.

Amongst the biggest recent advancements highlighted by Gartner are Layer 2 scaling solutions, DeFi, non-fungible tokens (NFTs) and cross-chain interoperability.

At first, one or two of the mentions on the downward curve appear out of place. While sentiment is certainly negative for NFTs and Retail CBDC, there is a fair amount of hype surrounding the tokenization of real-world assets (RWA) at the moment.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.