After this weekend’s G20 finance meeting the group issued a communiqué covering several matters including crypto-assets. They set an October deadline for the Financial Action Task Force (FATF) to report on how to apply existing standards to crypto-assets.

FATF

The FATF is an independent inter-governmental body that develops and promotes global policies to protect against money laundering, terrorist financing and financing of WMDs.

In preparation for the G20 meeting, they published a report. This included a statement that “besides small-scale drug trafficking and fraud, the link between virtual currencies/crypto-assets and other predicate crimes appears to be growing.”

The organization noted that it’s not entirely clear how to apply their existing FATF rules to crypto-assets.

“There is an immediate need to clarify how the FATF definitions and Recommendations concerning customer due diligence, money or value transfer services, wire transfers, supervision, and enforcement apply to virtual currency/crypto-asset providers and related businesses.”

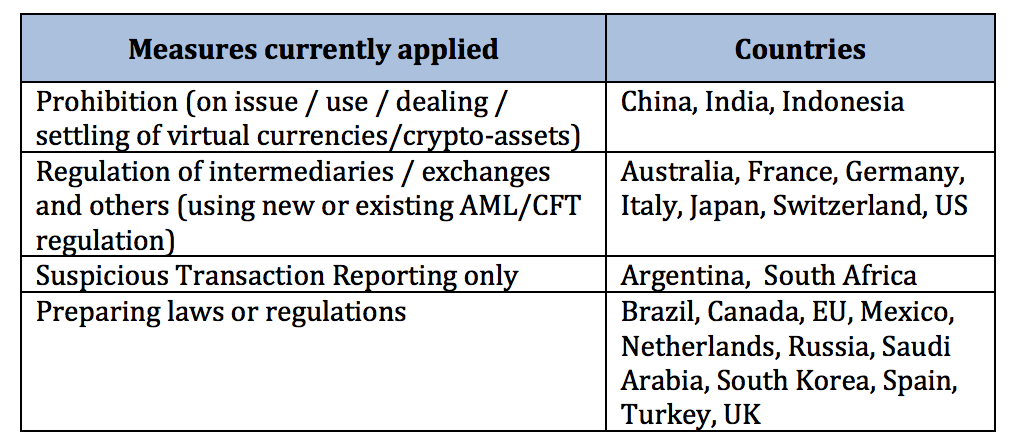

The organization also reviewed how countries are currently addressing the issues at a national level. The table below shows the results.

G20 comments

Back to the G20 communique which included some positive sentiments.

“Technological innovations, including those underlying crypto-assets can deliver significant benefits to the financial system and broader economy. Crypto-assets do, however, raise issues with respect to consumer and investor protection, market integrity, tax evasion, money laundering and terrorist financing.”

“Crypto-assets lack the key attributes of sovereign currencies. While crypto-assets do not at this point pose a global stability risk, we remain vigilant.”

Financial Stability Board

The Financial Stability Board (FSB) also prepared a report in preparation for the G20 meeting.

The FSB in conjunction with the Committee on Payments and Market Infrastructures (CPMI) have established metrics to monitor the financial stability implications of crypt-assets.

Additionally, The CPMI is performing an analysis on payment innovations.

The International Organization of Securities Commissions (IOSCO) created a Consultation Network to discuss ICOs. It’s exploring how to address domestic and cross-border ICO issues for investor protection. Plus it’s looking into regulatory topics around crypto-asset platforms.

The Basel Committee on Banking Supervision (BCBS) is quantifying the materiality of direct and indirect bank exposures to crypto-assets. It’s also trying to clarify how to address this exposure.

Hence there’s a considerable amount of activity, and by October there should be further clarification regarding money laundering rules.