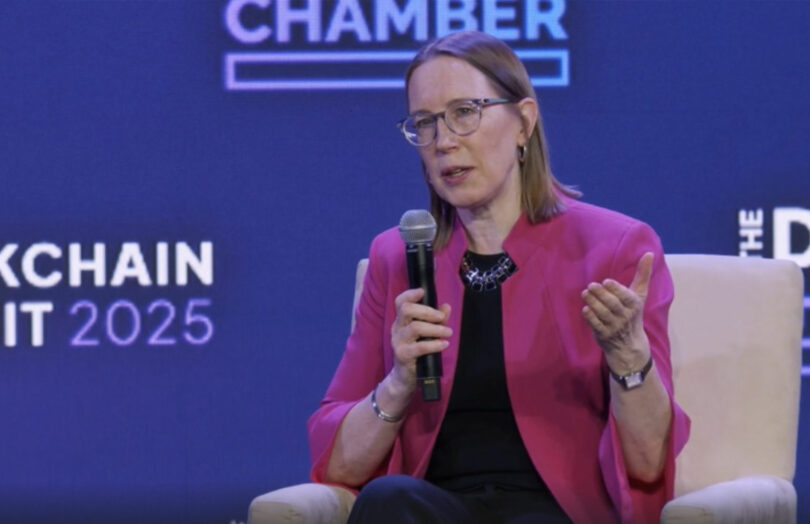

Last Friday the Securities and Exchange Commission (SEC) held its first Crypto roundtable. During a speech at the DC Blockchain Summit yesterday, Commissioner Hester Peirce discussed some of the takeaways from Friday’s event.

One was the need for the Commission to consider crypto transactions separately from assets.

“Many crypto assets themselves are not securities, but primary offerings of crypto assets for capital raising purposes are securities transactions. Accordingly, staff is open to inquiries about how to conduct such offerings as either registered or exempt transactions. And the Task Force welcomes well-reasoned requests for no-action letters or exemptive relief,” she said. Commissioner Peirce leads the Crypto Task Force.

She believes that the sector raises many questions that highlight the need to reevaluate existing regulations.

She noted the numerous regulators who might play a role in regulating digital assets and outlined several ways that Congress could make those lines clearer, including appointing certain agencies as regulators for specific types of digital assets.

However, the crossover between the jurisdiction split and the difference between a transaction and the crypto-asset itself can make things messier.

One example is if a crypto exchange primarily trades “commodities”, but a few of the assets raised funds (investment contracts) under an SEC exemption. The entire exchange could fall into the CFTC’s jurisdiction, provided none of the assets themselves are considered to be securities (apart from the investment contract fundraising). She considered another example that could fall under the SEC’s jurisdiction.

One of the key proposals for legislators is to enshrine the right to peer-to-peer trading without a centralized platform.

Meanwhile, given the success of the first Crypto roundtable, the SEC has announced four more, each covering specific topics: crypto trading, crypto custody, tokenization and DeFi.

The first roundtable recording is now available on YouTube.