Today Reuters reports that Fnality, backed by 15 global financial institutions, will launch its wholesale stablecoin next year at the earliest. Fnality prefers to call itself a payment system and moved away from its previous branding of the Utility Settlement Coin.

The aim of the payment solution is to enable on-chain settlement between financial institutions using digital cash deposited at central banks. In the first instance, the planned currencies are the U.S. dollar, Euro, British pound, Canadian dollar and Japanese Yen. To get started, Fnality requires approval from a central bank. And each jurisdiction needs an independent operating company. We previously looked at the solution in depth.

Given that it’s already quite late in the year, it’s no surprise that Fnality says it won’t be launching this year. If or when it gets a central bank go ahead, there will be a considerable lead time for banks to get going. One of the other challenges is that central banks have become more interested in central bank digital currencies (CBDC). Hence, they have to figure out how private solutions will fit in. The Banque de France recently announced a trial for a wholesale CBDC euro. Notably, none of the Fnality participants seem to be taking part.

While the regulatory aspect is the bigger challenge, in the meantime Fnality has progressed its technical solution. Last month it made the latest version available so that participant hosted nodes can connect to Fnality hosted servers and simulate tokenizing their central bank cash.

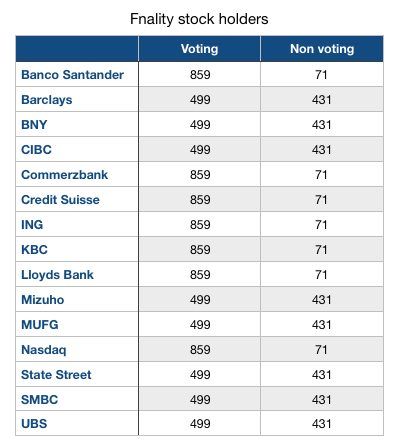

In other news, we looked at the shareholdings in Fnality. All 15 investors hold the same amount of shares (930), but they don’t all have the same votes. What’s even more surprising is that the founding bank UBS is one of the banks with less votes. Eight of the 15 firms were announced as part the project prior to incorporation, though there were more that kept their participation confidential. Six of them have fewer votes except for Santander and Credit Suisse.