Today, the Financial Stability Institute, part of the Bank for International Settlements (BIS), published a review of stablecoin regulations across several jurisdictions. At a high level, many national regulations address the same general topics but differ significantly in detail, creating scope for regulatory arbitrage.

“A consistent regulatory framework, as well as its global implementation, is essential to address stablecoins’ risks, prevent regulatory arbitrage and ensure a level playing field in the digital asset ecosystem,” the study concludes.

The paper explores how different jurisdictions compare across several topics. These include:

- licensing approaches

- composition and attestation of reserves

- safeguarding and segregation of reserves

- redemption rights

- capital and liquidity requirements

- governance and risk management

- disclosure and marketing.

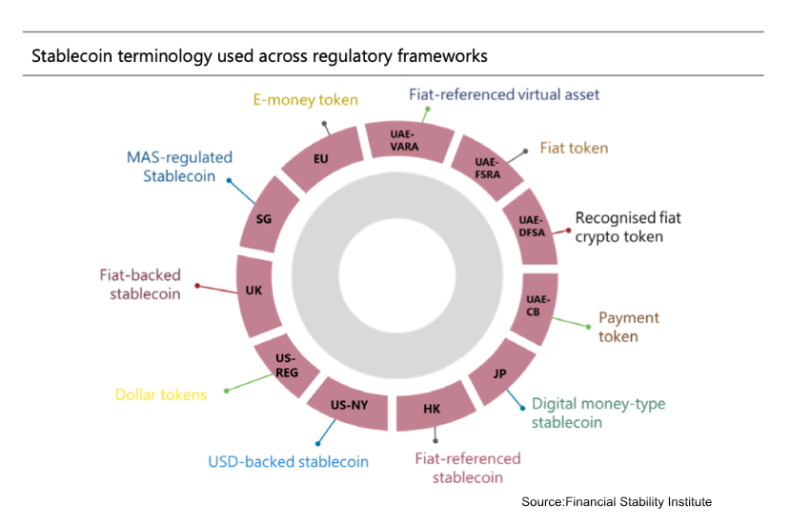

Key differences start with the terminology that determines the scope of regulations.

The paper highlights, “In some jurisdictions, this terminology refers to whether in-scope stablecoins are pegged to a single fiat currency and/or whether they are primarily intended to facilitate payments. In others, the definition refers to whether stablecoins are backed in whole or in part by fiat currencies.” Hence, some algorithmic stablecoins are included or subject to a separate framework or prohibited.

While acknowledging potential benefits such as financial inclusion and lower costs, the authors state these “have not yet materialised”. However, the risks, such as a stablecoin losing a peg and their use for nefarious purposes, already exist.

High level recommendations encourage diversity

A major part of the concern is the complete lack of regulation in many jurisdictions. However, several of the countries compared in the paper formulated their frameworks after the Financial Stability Board (FSB) published its recommendations for global stablecoin arrangements. We’d observe that the FSB recommendations were high level and only related to global stablecoins, leaving precisely the scope for variation we’re seeing.

With stablecoins still relatively nascent, particularly for mainstream payments, the paper notes the challenge of striking a balance between fostering innovation and mitigating risks. It says work is under way by standard setting bodies to support the efforts. We interpreted a desire to bring the already published frameworks closer together. But that might have been simpler a couple of years ago.

Bank risks aren’t homogenous either

Beyond the paper, it’s worth comparing stablecoins to banks, which also come with diverse risks. Analysts might understand key risk differences between banks, but most retail customers do not. That’s until something goes wrong. So, while the desire to homogenize the regulation of stablecoins is understandable, it’s worth acknowledging that most of the frameworks are at least addressing the key risk areas, even if not in a uniform manner.

Much of the motivation to regulate stablecoins was driven by the alarm of central banks when Facebook proposed the Libra (Diem) stablecoin. That’s why the FSB focused on global stablecoins. Now central banks are worried that the likes of Visa could be next to launch.