In a Linkedin post, Mike Cagney co-founder and CEO of blockchain startup Figure Technologies announced plans for a cryptocurrency-backed mortgage to launch in April. No cash down payment is required, but the real estate mortgage is secured by both the property as well as 100% of the loan value in cryptocurrency – Bitcoin or ETH. Plus the rate could be as much as 5.99%. So if someone wants to buy a $20 million home, they deposit $20 million in collateral.

We can totally see how this double security works for the lender. But in terms of borrowers, it might only appeal to those who – for some reason – can’t get a mortgage any other way. We’ll show below why this is an expensive route even if someone wants to keep HODL onto their cryptocurrency.

According to Cagney, “The only underwriting is to make sure you don’t have so much debt that the crypto can’t suffice for ability to pay.” If the crypto prices collapse, there is a potential margin call, but there is a generous cushion, as Cagney pointed out.

If the cryptocurrency price rises significantly, some of the collateral provided to Figure can be withdrawn provided it’s more than 125% of the loan value. Monthly payments can be made in fiat or using collateral.

One other detail: Cagney said the crypto used as a deposit wouldn’t be rehypothecated. In other words, it won’t be lent out. But we wondered how you define rehypothecation in the crypto world. For example, does it include or exclude staking? Cagney confirmed the collateral would not be staked, it would be dormant at a third party custodian.

Why a crypto mortgage won’t make sense for most

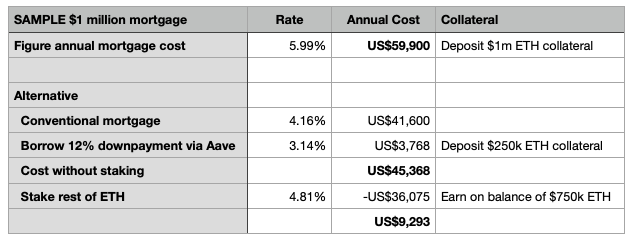

Our research shows the average American will make a 12% downpayment on a mortgage. With Figure, you’re making a 100% downpayment, albeit in a volatile asset. And a 30-year conventional mortgage would cost around 4.16%, whereas the rate offered by Figure is for a non-qualifying mortgage which will be around 5.99%. We assume that the home buyer does not want to sell their cryptocurrency.

It would make more sense to go to a DeFi exchange like Aave and deposit enough ETH to borrow the 12% downpayment. That would cost you around 3.14% at today’s prices. So even if you put down 25% of your ETH as collateral (more than needed) for the 12% home downpayment, you’re already significantly ahead.

With this combination, our crude calculations below show that the mortgage would cost almost 25% less than the Figure option. There are plenty of caveats, such as DeFi rates vary considerably.

However, the 75% balance of the cryptocurrency that’s not used for the downpayment loan could then earn a return through staking. And current staking rates are 4.81%. After offsetting that staking income against the mortgage payment, the comparative net payment on a $1 million home loan would be less than $10,000 a year. That’s less than one sixth of the Figure cost.

Crypto is volatile and all the rates are variable, so who knows what the final figures might be. But it’s more than likely that the Figure mortgage will prove more expensive unless the borrower has no other options.

Don’t get us wrong. It makes a ton of sense for Figure. And Figure is already a major player in the mortgage space, having acquired mortgage lender Homebridge. It’s also doing some cool stuff with bank-backed stablecoins through the USDF consortium.

This is NOT financial advice. Do your own due diligence.