In May the U.S. Federal Reserve published its 2022 annual report on the economic well-being of U.S. households. A section dedicated to cryptocurrency shows a higher proportion of the poorest using crypto for retail or P2P payments, although overall figures are still low.

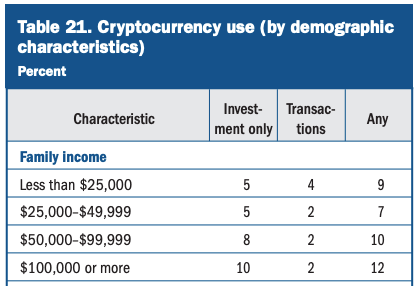

The survey asked people whether they used crypto for payments versus investments. Amongst the lowest income group with income under $25,000, 9% of those surveyed used crypto for any purpose. The group split into 4% that use it for payments and 5% that see crypto as an investment. In other words, 44% of the low income crypto group uses it for payments.

In contrast, just 16% of the wealthiest crypto holders (2 out of 12) said they made a payment with crypto.

Unsurprisingly, the same pattern repeated for the unbanked. Five percent of unbanked adults use crypto for payments, compared to 3% of those with bank accounts. Eight percent of people that use nonbank check cashing or money orders use crypto to send money, compared to 2% of those who don’t.

There were also significant variations in usage based on ethnicity. Half of those identifying as Black crypto owners used crypto for payments, compared to a third of Hispanic crypto users, one in five Asians and 11% of Whites.

However, the Fed added that the”use of cryptocurrency for financial transactions remained very low, even among groups who were more likely to use cryptocurrency in this way.”

Crypto holdings down, but not payment usage

Overall, the proportion of households using cryptocurrency for any reason dropped from 12% in 2021 to 10% in 2022. However, the decline is purely related to holding crypto as an investment. Usage for retail or P2P payments increased a little.

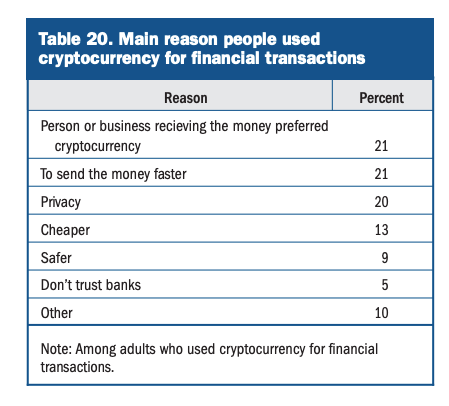

The three biggest motivations for using crypto for transactions were the recipient preferred it, it’s quicker, and for privacy. Each scored 20% or 21% of crypto payment users.

Credit to BaFin’s Christoph Kreiterling for highlighting the report on social media.