Facebook has confirmed that it currently has no plans to launch its Calibra wallet in India, according to Bloomberg. That’s because of India’s regulatory stance on cryptocurrencies. Last month India’s Economic Times reported that there’s draft legislation entitled “Banning of Cryptocurrency and Regulation of Official Digital Currency Bill.”

In its current form, the yet-to-be-published Bill makes cryptocurrency illegal and holding crypto a non-bailable offence. There’s even a proposed ten-year prison sentence for those who “mine, generate, hold, sell, transfer, dispose, issue or deal in cryptocurrencies”.

By adopting an aggressive stance, the government hopes to prevent money laundering. Given the Bill has support from the tax and customs departments, it appears the government is keen to address digital black market trading.

India is Facebook’s largest market, with 270 million users, whereas the U.S. has 210 million users. Facebook’s revenues from the U.S. dwarf that of India. And financial services were viewed as a way of improving the revenues per user.

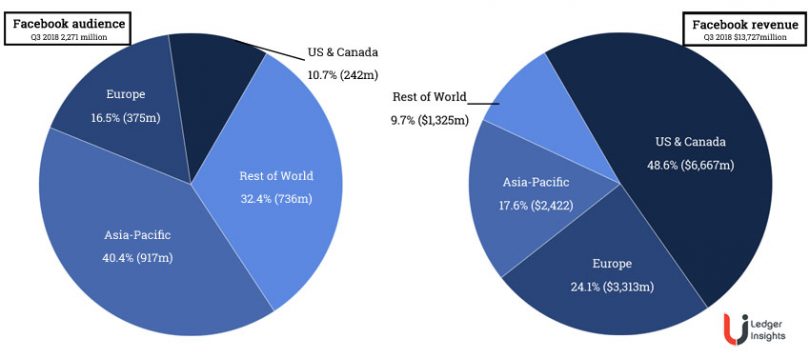

Asia-Pacific (917 million users) makes up more 40% of Facebook’s user base, but just 17.6% of its revenues. The U.S. and Canada account for only 10.7% of users but 48.6% of income.

The irony is that the initial rumours about Facebook’s plans were oriented around remittances to India. It’s entirely possible that was the case, as the strategy doubtless iterated over time.

Facebook engaged with the Indian regulators and, according to Bloomberg, still are.

Perhaps it’s a coincidence, but three months ago, the National Payments Corporation of India (NPCI), owned by 56 banks, announced plans to set up a blockchain payments solution.