Yesterday the European Central Bank (ECB) published a paper about global stablecoins such as Libra. The emphasis was on what regulations might be relevant to the digital currency, depending on the stablecoin structure, and it particularly explores the asset management function. It further estimates the potential size of Libra’s assets depending on whether it is used purely for payments or also as a store of value.

A stablecoin usually has three aspects, the payment mechanism, the assets that back the digital currency, and the user interface or wallet. From the ECB’s perspective, payments and wallets are comparable to traditional payments systems, schemes or instruments and hence are easier to classify from a regulatory perspective.

How a stablecoin is designed and manages assets will determine its regulatory status. If token holders are guaranteed to be able to redeem coins at par, and the issuer grants no credit, it falls under EU e-money legislation. But if the issuer gives loans, then the credit provider will need a banking license.

If the investment includes assets that may have some risk, such as government securities, and coin holders are entitled to a pro-rata share of the value of the assets, then it will be regarded as a collective investment undertaking. For regulatory purposes, whether it’s considered a money market fund or not will depend on the assets and their maturity. As an aside, a Federal Reserve lawyer outlined a similar scenario for the U.S.

However, if the coin holder does not have a claim on the issuer or the assets backing the coin, then it may fall outside of the current regulatory framework.

Global stablecoin risks and Libra’s potential size

The rest of the paper explores the potentially significant risks to financial stability. For example, if there was a run on a stablecoin that was in widespread use. Then if assets were liquidated urgently, this could affect the rest of the financial system, including short term government debt markets. Also, it could crowd out bank deposits and hence the banking system’s ability to grant credit.

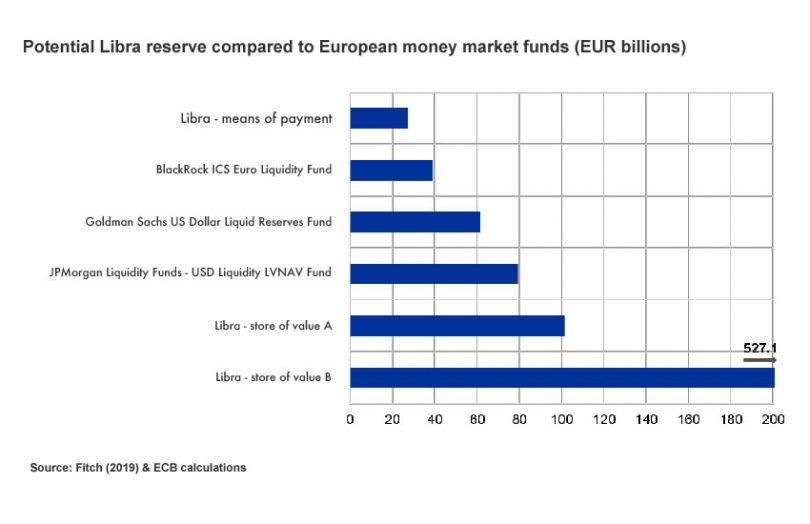

The ECB estimates the potential size of Libra’s assets and contagion simulations. It calculates the potential global assets could vary from €152.7 billion ($165 billion) if it is mainly used for payment versus up to €3 trillion ($3.24 trillion) as a store of value. It predicts 10% of Libra users could come from the Euro area.

Because Libra has stated that 18% of the currency would be backed by Euros, and only 10% of the global assets are likely to be used by Europeans, it could result in net inflows into the European short term funding market. And Libra could become one of Europe’s largest money market funds.

The €527.1 billion ($570 billion) in the diagram represents Europe’s 18% of the upper global estimate of €2.9284 trillion in potential Libra assets.