Euroclear UK and International (EUI) plans to join the Digital Securities Sandbox (DSS), an initiative that relaxes some laws to support the trading and settlement of tokenized securities on blockchain. It’s a big win for the UK, given the EU’s similar DLT Pilot Regime has failed to attract the largest incumbent financial infrastructures.

CREST is the only UK authorized central securities depository (CSD) and is owned by Euroclear, with EUI settling around £1 trillion in transactions daily. Following Brexit, 13 foreign CSDs are also authorized in the UK, including five other Euroclear subsidiaries.

The Bank of England and the Financial Conduct Authority (FCA), which are running the sandbox, deserve credit for listening to feedback. The biggest criticism of the EU’s DLT Pilot Regime was that the limits were too small for large financial infrastructures. Hence, the Prague CSD is a participant, but Clearstream won’t take part.

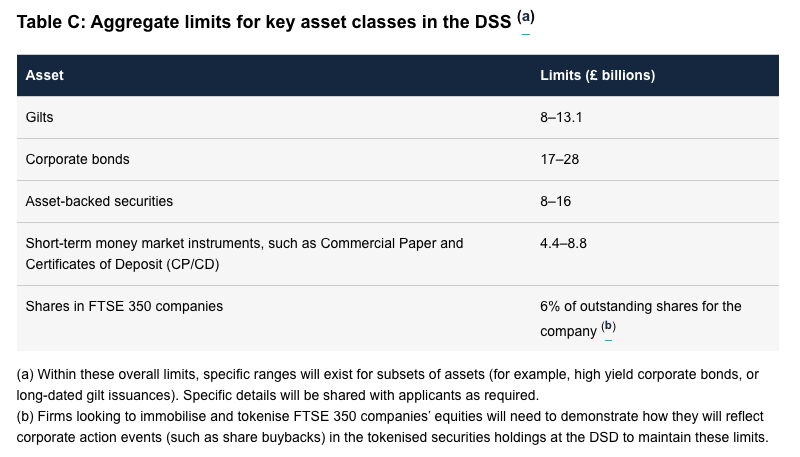

While the aggregate DSS sandbox limits for the entire market are not massive (see graphic below), following feedback during a consultation, the regulators adapted the rules to set custom volumes for each firm. With Euroclear as the sole UK CSD, they will likely be allowed figures close to the maximum limits, making their involvement more viable.

The maximum go-live limits for individual participants are:

- Gilts: £600 million (can request up to £1.25 billion)

- Corporate bonds: £900 million (firm can request up to £1.5bn)

- Asset-backed securities: £600 million.

- Money market instruments (eg, CP and CD): £300 million.

The limits can be raised at a later stage.

The Digital Securities Sandbox limits in context

While the figures look small in the context of current conventional activities – Euroclear has custody of £5 trillion in UK assets – the amounts look reasonable when compared to Euroclear’s digital securities activities.

Euroclear has its D-FMI platform for digital securities. In late 2023, the International Bank for Reconstruction and Development (IBRD), part of the World Bank, issued a €100 million digital note which was listed in Luxembourg. Last year the Asian Infrastructure Investment Bank (AIIB) issued a $300 million digital bond which rose to $500 million after a tap. And in November, Caisse des Dépôts et Consignations (CDC) issued a €100m digital bond using D-FMI as part of the ECB wholesale DLT settlement trials.

“We innovate to bring connections to financial markets, and by participating in the DSS, we believe we can make a connection between the markets of the present and the digital and data-enabled markets of the future,” said Chris Elms, CEO of Euroclear UK and International.

“We recognise the potential of DLT to transform securities transactions and this work dovetails with the Government’s overall strategy to advance digital infrastructure across financial markets.”

Meanwhile, so far three startups have passed the “Gate 1” DSS application process, which does not allow them to go live (yet): ClearToken CSD, Archax’s Montis Digital and BPX Markets which is building an exchange for tokenized real estate securities. It’s possible that Euroclear could launch in the sandbox before the startups, because it has a far shorter approval process given its existing designation.