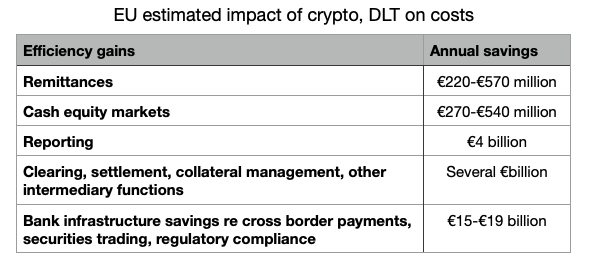

Earlier this month, the European Parliamentary Research Service published a document that estimates the combined benefit of EU crypto and DLT regulations at €33 billion annually. The legislation includes MiCA for crypto-assets and the DLT Pilot Regime for capital markets. That figure counts the efficiency savings but not the potential gains from innovation.

However, beyond the impact of blockchain legislation, the number also includes benefits from cyber resiliency and the use of data in the financial sector. But the breakdown of the numbers below is mainly the impact of blockchain.

Previous EU research estimated the crypto and DLT benefits at between €27 billion and €55 billion, including the innovation impact.

One or two of the figures might be a little outdated. For example, the bank infrastructure savings are based on a 2015 Oliver Wyman & Santander report which predicted the level of benefit would be evident by 2022. In 2016, SWIFT estimated the impact on middle and back office costs could be $50 billion. In fairness, most innovations take longer than expected to materialize. And when they do, the impact is often larger than predicted.

However, more recent estimates of the innovation impact are likely to be higher. For example, BGC estimated that asset tokenization will reach $16 trillion by 2030. If that yields benefits of half of one percent, that amounts to $80 billion.

The EU research does not paint a glowing picture of the crypto asset and DLT sectors. A significant proportion of the text outlines a wide range of risks.