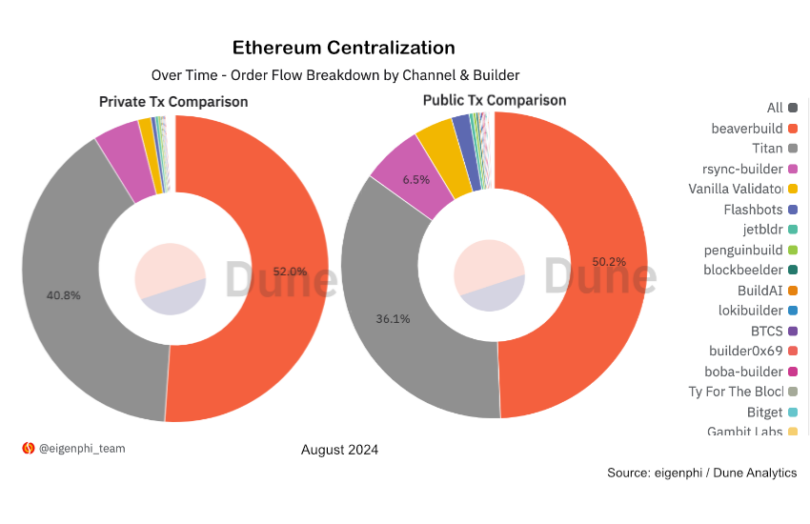

One of the many goals of the 2022 Ethereum Merge was to make Ethereum more decentralized. From a validator perspective, it’s not doing badly. Statistics show Coinbase is the largest, controlling almost 12% of staked ETH (although some claim it’s closer to 30%). However, validators don’t create the content of the blocks. Block builders are the ones who include transactions, decide on their order and then bid in the auction to get their block included. This month a single block builder, Beaverbuild, has built more than half of Ethereum’s blocks.

Over 85% of blocks were built by the top two builders, and more than 90% by the top three.

This drive towards centralization is driven by maximal extractable value (MEV) where the block builder reorders transactions to gain an advantage. This usually involves a combination of front running pending transactions and arbitrage.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.