Today venture capital fund LeadBlock Partners published its enterprise blockchain report based on a survey of 250 startups it has interacted with. One of the findings was that funding requirements in the next 18 months have accelerated by almost two and a half times, with half of the companies expecting to raise more than €3.9 million ($4.4m) compared to €1.6 million ($1.8m) in its survey 18 months ago.

To date, these startups have raised a median of €1.73 million ($1.94m), up from €1.4 million ($1.57m) in the 2020 survey.

Average startup revenues are significantly higher compared to last year, by a factor of three and a half. And double the number of startups said they had incomes above €1 million ($1.12m). LeadBlock clarified that it didn’t include digital assets startups in those figures. For example, crypto lender BlockFi is now in the LeadBlock portfolio and wasn’t last year. It has pretty significant revenues, so that would have distorted figures.

According to the LeadBlock survey, a major challenge is a lack of blockchain understanding amongst investors. And surprisingly, the situation has deteriorated since last year. Asked if investors are knowledgeable about blockchain technology, 58% disagreed, up from 49% last time, with another 24% on the fence. Sixty percent of investors don’t differentiate between blockchain technology and cryptocurrencies.

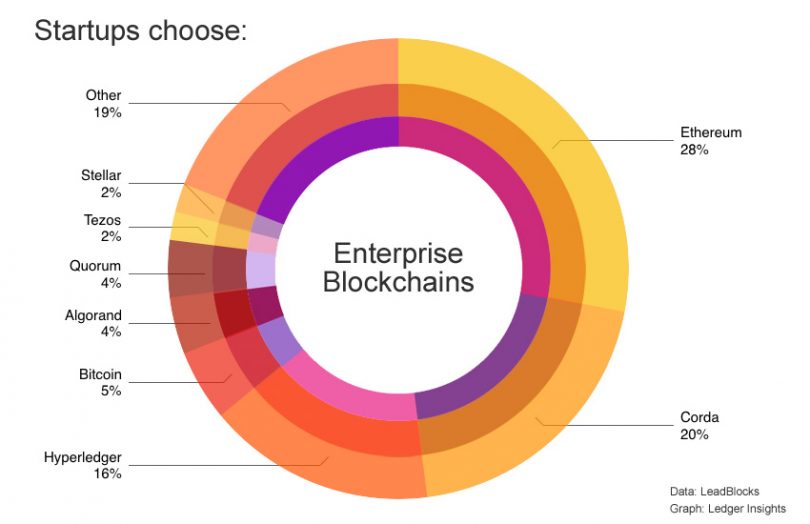

On the topic of technology, 30% of startups are considering switching blockchain protocols, and of those, half plan to explore challengers Algorand, Quorum, Tezos and Stellar.

The big three blockchains remain Ethereum, Corda and Hyperledger protocols, although Corda overtook Hyperledger compared to last year. While Ethereum is ahead at 28%, the figure might be understated as Hyperledger protocol Besu is based on Ethereum, as is enterprise blockchain Quorum.