The UK’s Ministry of Justice has introduced a new Bill to Parliament aiming to clarify that digital assets and certain other things can be considered as ‘property’ in England and Wales. It will cover many digital assets such as cryptocurrencies, non-fungible tokens, voluntary carbon credits and in-game digital assets.

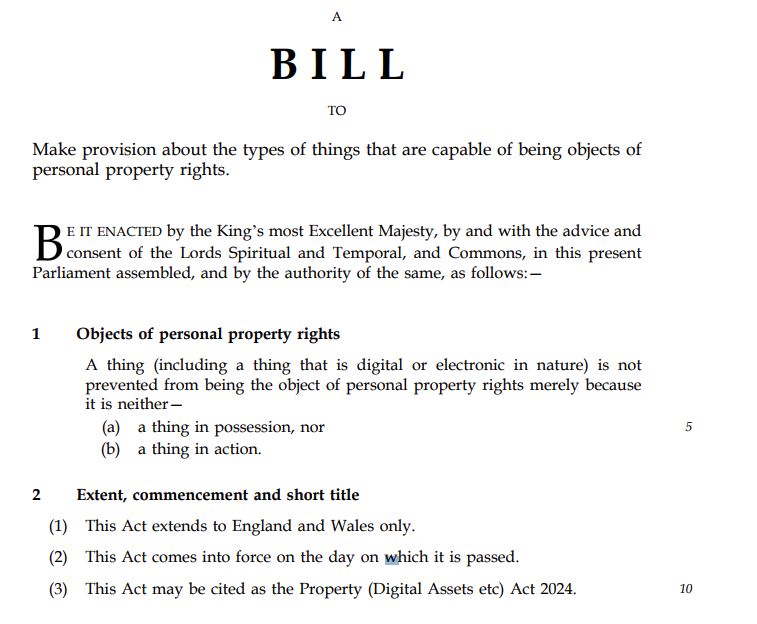

It follows an extensive review by the UK’s Law Commission, which drafted the legislation and conducted a consultation. While the thinking behind it is not straightforward – there was a 300 page report – the draft legislation is extremely short. See below.

As the legislation points out, until recently, there were only two types of personal property. These include things in possession – usually physical things like a car, house or watch – and things in action. The ‘action’ part relates to legal action, or the right of a person to sue. Hence, it includes contracts (such as a debt), copyright, or the right to enforce a court judgment.

Digital assets such as Bitcoin don’t fall neatly into these categories. Recent case law has started to recognize this, but the statute will help to remove ‘lingering uncertainty’, according to the Law Commission.

A third type of personal property

However, the third type of property won’t cover every digital asset. For example, if the digital asset involves a right to legal action, the law will categorize it as a thing in action. The 300 page paper discussed this point with regards to permissioned blockchains, where participation usually incorporates legal contracts.

Hence, any digital asset issued on a permissioned blockchain will be a “thing in action”.

Likewise, many stablecoins represent a right to redeem the digital currency for a unit of fiat currency and would be a “thing in action”. However, algorithmic stablecoins are a different matter.

The legal experts provisionally recommended that the third group might have three features, although this does not form part of the proposed statute:

- it is composed of data represented in an electronic medium, including in the form of computer code, electronic, digital or analogue signals;

- it exists independently of persons and exists independently of the legal system; and

- it is rivalrous.

By rivalrous they mean if one person consumes it, someone else can’t. This distinguishes a digital asset from a data file which can be copied pretty much infinitely.

The Law Commission subsequently relaxed the first criterion relating to data. The intent is to allow considerable flexibility, which can be later clarified in the courts if necessary. Given digital assets will evolve, they want to avoid being overly prescriptive and creating a ‘hard boundary’ for the third category.

“It is essential that the law keeps pace with evolving technologies and this legislation will mean that the sector can maintain its position as a global leader in cryptoassets and bring clarity to complex property cases,” said Justice Minister Heidi Alexander.

Other Law Commission recommendations

The Ministry of Justice also asked the UK Jurisdiction Taskforce (UKJT) to provide non-binding guidance on a few detailed areas of remaining legal uncertainty for digital assets.

The Law Commission report outlined recommendations regarding an extremely important issue for finance – the treatment of digital asset collateral. That topic is still under consideration.