As part of a recent Deutsche Börse paper on the European capital markets union, the company called for a permanent wholesale CBDC (wCBDC). This follows a series of wholesale DLT settlement trials that ended last November. Twice during the last couple of weeks, ECB Director Piero Cipollone has stated that a short term solution for central bank money settlement for DLT will be put into place soon. During a recent Banque de France event, he said the central bank is working on setting this up in months, not years.

There’s a twofold driver behind the relatively urgent need. On the one hand, if on-chain cash is not available, institutions will start using other alternatives such as tokenized deposits or stablecoins to settle DLT securities transactions. Central bank money is usually used for wholesale securities settlement to minimize risk, so alternatives increase risks.

The second driver is market demand. Institutions believe a wholesale CBDC or (as a fallback) some DLT friendly central bank settlement solution is needed to encourage DLT adoption. The recent trials involved both a wholesale CBDC and two other solutions that interoperate with existing central bank payment systems. Hence, the short term solution may or may not be a wCBDC. As the trial drew to a close in November, companies asked for continuity in order to avoid losing momentum. That included someone from Clearstream, which is part of the Deutsche Börse Group.

The trials ended and there is currently no solution in place. However, Mr Cipollone said that there will be an ‘interoperability solution’ available in the short term, once the ECB has established some standards with the industry. In other words, it will be one or more of the solutions already tested.

A longer term wholesale CBDC solution

Longer term the aim is for a more integrated solution. This might be some kind of shared ledger that includes central bank money, tokenized deposits and tokenized assets, a topic Mr Cippolone mentioned last year. Speaking last week at the Frankfurt Digital Finance event (see video below), he said that the alternative being considered was an ecosystem of fully interoperable solutions, including legacy systems. That is a topic it is currently exploring.

Stepping back, in one of its papers (summary or full version), the Banque de France outlined three wholesale CBDC models:

- interoperability through synchronization (already tested)

- a single ledger

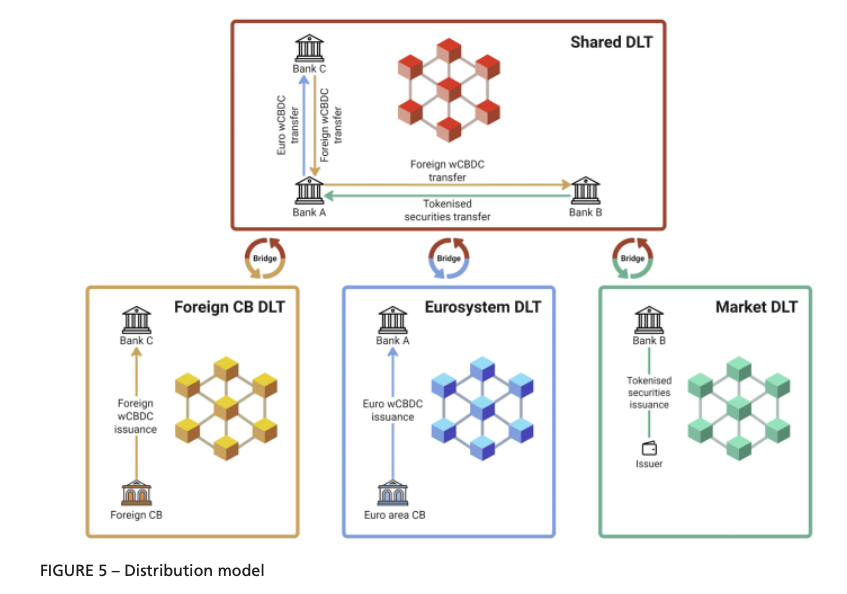

- a distribution model involving an integrated shared ledger.

The distribution model is also an ecosystem of separate DLT networks. However, it differs from the synchronized interoperability version by involving a shared ledger where settlement takes place. Hence, in order to enable delivery versus payment, an asset will be bridged from an asset ledger onto the shared ledger. Likewise, a CBDC would be bridged from the central bank ledger to the shared ledger. There are pros and cons with each path.

In addition to the capital markets union, Mr Cipollone also spoke about the need for a retail digital euro because of the fragmentation of retail payments across Europe.