Last week the European Central Bank (ECB) provided a status update on the design of an offline digital euro. The draft legislation for the central bank digital currency (CBDC) requires that the offline version be privacy preserving. The report covers details about the devices to be used and some of the challenges. Unlike the online wallet, there will be a single technology provider for the offline solution, which needs to integrate with apps provided by payment service providers.

The digital euro offline solution is meant to be cash-like and doesn’t involve intermediaries, so there’s no anti-money laundering (AML) when it comes to transactions. However, the ECB notes that this is “subject to legislation excluding (it) from AML monitoring.” Hence, AML will need to be conducted during the wallet’s funding and defunding.

There are numerous ways to top up, including using an ATM, a bank branch or retail outlet. Using a mobile phone wallet, the user can switch some of their online digital euro into the offline digital euro balance.

Offline CBDC devices

There are currently three options regarding offline devices: a smartphone, a smartcard similar to a debit card, and a battery-powered smartcard. The latter includes buttons and a display. It is available as part of China’s CBDC trials, and there’s a photo of one at the bottom of this article.

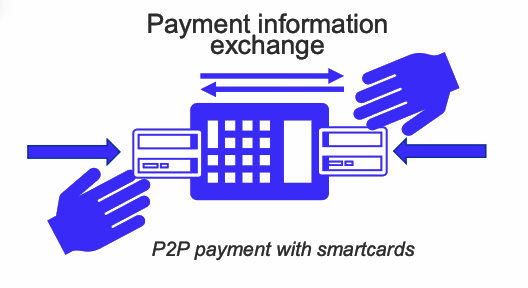

Offline CBDC is designed explicitly for person-to-person (P2P) payments and in-store point-of-sale (PoS) usage. It isn’t intended for e-commerce, as it involves being online!

There’s a challenge with smartcards. Their functionality is pretty basic, so how do you make P2P payments? The answer is using a special bridge device similar to the card readers that banks give customers for online banking.

On the other hand, if you have a battery powered smartcard or a phone, then you’re in luck – provided Apple plays ball!

Apple, antitrust and offline tap to pay

The ECB notes that in order to enable offline payments with a smartphone wallet it needs access to two functional pieces – near field communications (NFC) and the phone’s secure enclave which stores keys. Apple notoriously restricts NFC access to the Apple Wallet. So no third party wallets can use tap to pay. However, there is a path to resolution.

In 2022 the European Commission sent an antitrust statement of objections to Apple regarding the NFC restriction. In January this year, Apple said it was willing to allow third party access to wallet providers in the EU. Now the Commission is going through public feedback on Apple’s proposals.

However, it will be tricky for Apple to restrict access to the EU. Last month, the U.S. Department of Justice and several states sued Apple on antitrust grounds. The litigation covers more than NFC, but the lawsuit addresses the topic at length as it prevents financial institutions from providing tap-to-pay using an iPhone.

So the developers might have to wait a little longer to get access, but it should happen. When the ECB requested calls for vendor applications in January, the offline solution had the largest budget – starting at €220 million ($234m) and rising to €662 million ($703m) over the four year period.