Today the European Central Bank released a report summarizing the results of its three-month digital euro survey, which attracted 8,221 responses. If faced with a choice of an offline solution for a privacy-oriented digital euro, versus online with innovative and added value services, 53% of citizens prefer offline with another 34% looking for a hybrid approach, and just 13% want online only.

One of the challenges with the central bank digital currency (CBDC) survey results is the degree of variation between countries. For example, in the same question, more respondents said they wanted a hybrid versus offline approach in Italy, Portugal and Latvia. In contrast, other countries were far more definitively in favor of the privacy-centric offline system, such as Germany, Austria, and the Netherlands which all scored more than 60%.

The reason for breaking down the country’s results was partly because Germany dominated the survey responses accounting for a whopping 47% of respondents, with Italy the second highest country at 15%. Men accounted for 87% of all responses.

Despite the strong regard for transaction privacy, less than one in ten respondents wanted anonymity.

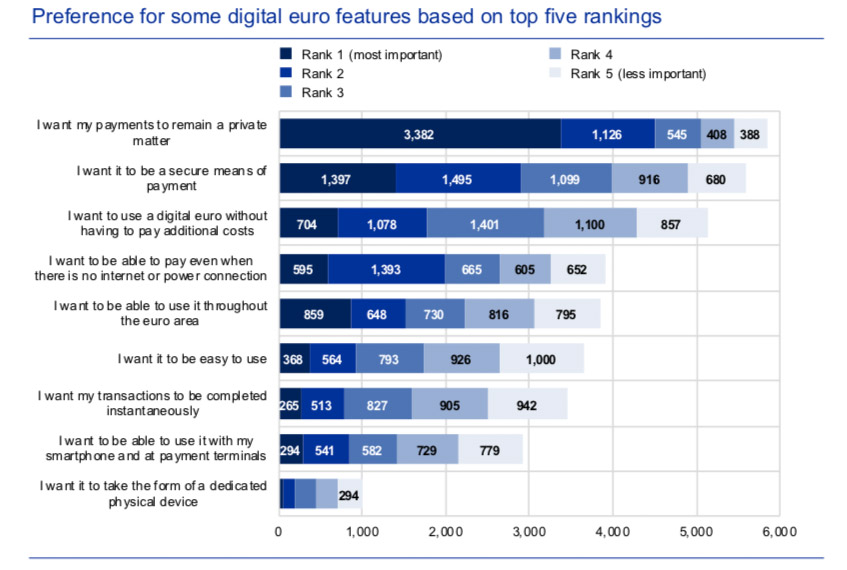

There was a question to rank different features. “I want my payments to remain a private matter” was overwhelmingly the most popular option. 57% ranked this as the number one feature, with another 19% putting it second.

What’s somewhat surprising is that privacy even ranked above security. If the payments are not secure, not only are they not private, but you are likely to lose your money. Perhaps respondents just assumed payments would be secure, otherwise nobody would use it.

The most preferable features of a digital euro are privacy, security, usability throughout the euro area, absence of additional costs, and usability offline.

Other highlights included half of citizens (versus business respondents) suggested limits on the amount of digital euro that can be held and /or tiered remuneration. Speed, cost and transparency of exchange rates are desirable features for international payments, with at least one of these three mentioned by a third of people. But most citizens and businesses think the use of a digital euro outside of the euro area should not be limited.