The European Central Bank (ECB) recently provided an update on the digital euro project to the Eurogroup, an informal club composed of the Eurozone’s finance ministers. It honed into a concept recently gaining prominence among those closest to the central bank digital currency (CBDC) initiative: digital financial inclusion.

The European Central Bank (ECB) has expanded the focus from the unbanked population to those with low digital or financial skills and is now considering new measures to facilitate vulnerable groups’ access to the digital euro. Still, the introduction of a CBDC could negatively impact cash usage and thus counter the efforts to enhance financial inclusion.

Digital financial inclusion

The Eurogroup’s update highlighted digital financial inclusion as a key principle of the CBDC project. “A digital euro will be designed to take on board people with no access to a bank account and with low digital or financial skills, as well as people with disabilities,” the presentation noted. It thus proposed some measures to make it easier for vulnerable groups to access the digital currency, including in-person support, physical digital euro payment cards, and (de)funding using cash at ATMs.

The lack of financial inclusion is a serious matter in many emerging countries, but in the Eurozone, where over 98% of the population has access to a payment account, the risks are mainly related to digital exclusion.

“It’s not about the bank account, it’s about how do you access that bank account digitally, and we know there is an issue, and we are being told very clearly by consumer organizations and the elderly associations that a lot of people have difficulty accessing digital services,” said Daniel McLean, Digital Euro Project Lead last month.

“We are not even calling this financial inclusion anymore, we are calling it digital financial inclusion,” he concluded.

Potential unintended CBDC impacts

One thing worth noting is that digital euro’s introduction could also have an unintentional negative impact on cash that could undermine the ECB’s efforts to enhance financial inclusion. The central bank has repeatedly noted that the digital euro will complement rather than replace physical cash, but with such similar features, one wonders if it could further contribute to the decline in the use of banknotes.

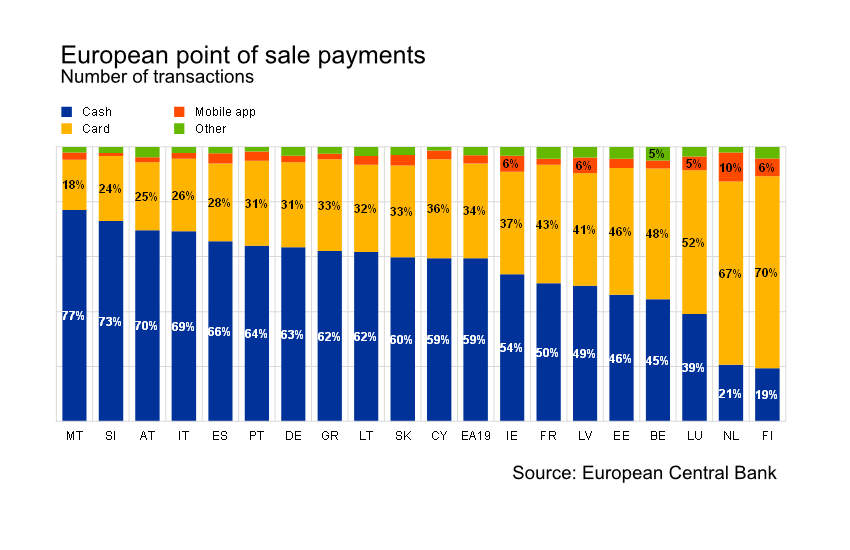

Cash still represents the majority of payments at the point of sale at the Eurozone level, but there are significant differences between countries as can be seen in the chart. If cash usage continues falling, the efforts to facilitate access of the low-tech-savvy to the digital euro could be frustrated.

For example, the Netherlands is one of the countries where cash usage is lowest at point of sale. Like other highly digital countries, the availability of bank ATMs is declining, impacting financial inclusion.