Four German firms, DG Nexolution, DZ Bank, Festo and Giesecke+Devrient (G+D) have jointly developed a prototype solution to support machine to machine (M2M) payments in offline mode using tokenized deposits.

As part of industry 4.0, rather than companies owning industrial machines, they can rent them in a pay-per-use manner. The machine owner might not want to release the manufactured goods without payment, hence the need for a digital wallet to support payment for each item produced. To avoid the need for human intervention, the recipient is a wallet associated with a device.

However, not all machines are necessarily connected to the internet. It might be in a secure facility where internet access is blocked. Or it might be underground without Wi-Fi access, such as a mine. Hence, offline usage might be necessary.

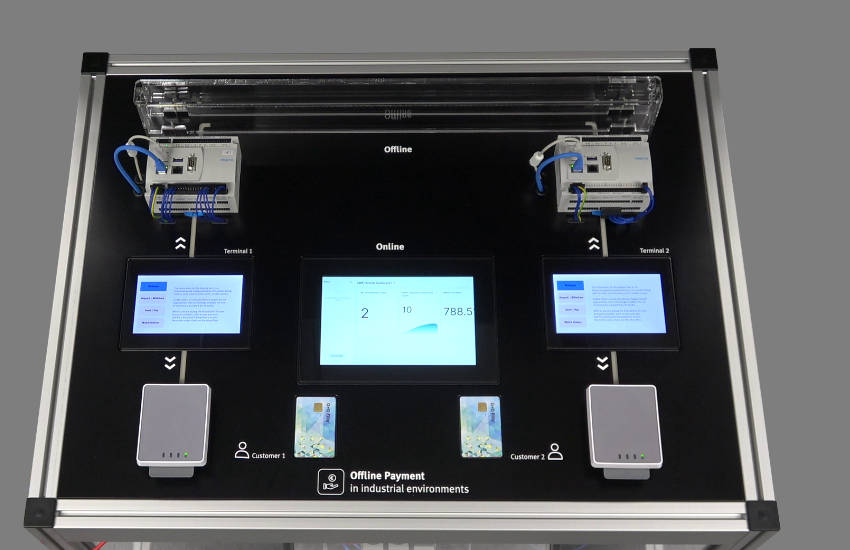

The prototype demonstrator has two wallets integrated with control units typically used on machines. A smart card is used to load money into the wallet, and the machines can transfer money between them.

Regarding the companies involved, DZ Bank is part of Germany’s Commercial Bank Money Token project in collaboration with the banking association. DG Nexolution is a service provider to the German cooperative banks, the Volksbanken and Raiffeisenbanken. It initiated the project and is its sponsor. Giesecke+Devrient (G+D) provided the payment infrastructure including the cards and interfaces. And Festo is an industrial automation company with 300,000 customers.

“Our customers’ requirements for automation solutions are constantly evolving. The ability to map new business models via tokens opens up interesting opportunities for our customers and us,” said Jacob Decker, Festo Project Manager, AI and Innovations.

“It was important to us not to stop at the concept phase, but to implement a demonstrator in order to present an adequate solution to customers.”

Commercial Bank Money Tokens (CBMT)

Last month the German Banking Industry Committee and the Federation of German Industries (BDI) published a report on the proofs of concept for Commercial Bank Money Tokens (CBMT), Germany’s tokenized deposit solution. Five banks took part – Unicredit, DZ Bank, Deutsche Bank, Commerzbank and Helaba.

CBMT is initially targeting large enterprises. While industrial solutions are not the only use cases, they are a particularly important in Germany. Hence, it’s critical for Festo to demonstrate the solution to potential customers. It plans to run a demonstration on September 18 at the Open Industry 4.0 Alliance convention.

Ledger Insights Research has published a report on bank-issued stablecoins and tokenized deposits featuring more than 70 projects. Find out more here.