On Friday China released the latest update to the digital-yuan mobile wallet app. After 23 versions of the first release, version 1.1.0 represents a significant expansion to the functionalities of the pilot central bank digital currency (CBDC) app.

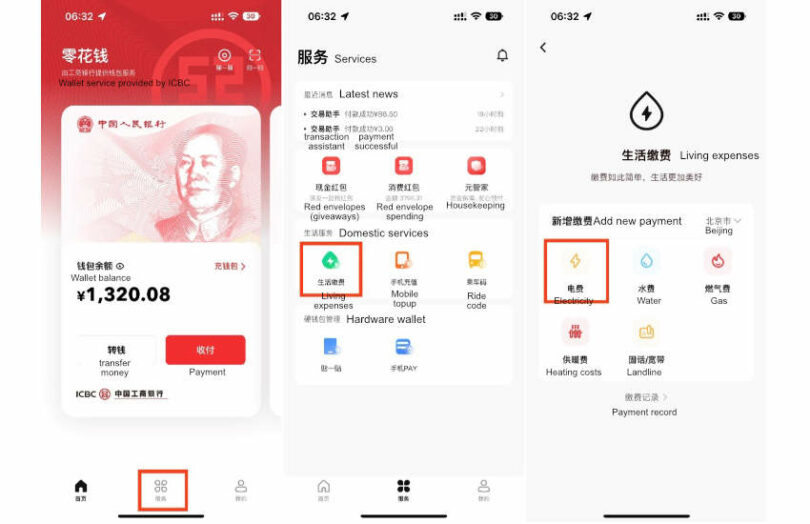

China’s central bank Digital Currency Research Institute is responsible for the app. Consumers access the digital yuan functionality via their banks. In the screenshot, the state-owned ICBC, China’s largest bank provides the eCNY services. However, the central bank only engages directly with the largest state-owned banks and Tencent-backed WeBank and Ant-backed MyBank. So other banks are reliant on the big banks for eCNY access.

The latest app update includes support for mobile payment top ups and utility bill payments tailored to each city.

The new version is also compatible with additional hardware wallets, including a mobile sim wallet that allows users to connect their SIM card to their digital-yuan wallets to make NFC payments. This means users can now transact using their phone even when it is switched off.

Increasingly, the software has become integrated into everyday transactions, and so far 140 merchant platforms have enabled quick payment options using the app. Many third party apps have also enabled digital yuan payment options, including major online retailers such as JD.com, Meituan, Taobao, Vipshop, and ride hailing apps like Didi.

Another feature, currently in the trial phase, is the use of shared QR codes, which could accelerate uptake of the CBDC. Users don’t always know which merchants will accept digital yuan payments, and if the use of shared QR codes proliferate, it would enable CBDC payments everywhere that accepts payments via Alipay, WeChat Pay, and UnionPay QuickPass.