The Bank of Israel conducted a thoughtful survey process for its Digital Shekel central bank digital currency (CBDC). It found that 51% of respondents had either a high or intermediate interest in the digital currency. Some of the responses received contrasted with other CBDC surveys. For example, privacy did not rank as particularly important, and interest in the CBDC increased with age.

That’s not to say the current Israeli central bank design doesn’t consider privacy. If introduced, the digital shekel would be accessed via payment providers, but the holdings would be directly with the central bank. However, the central bank would not have access to personal information.

The survey asked potential users to rank their interest on a scale of 1 to 10. Hence, the 51% figure is those who scored a six or above. We noted that the largest figures were in the extremes. Almost 21% of people gave it a ten, while 16% gave a score of one.

Respondents were asked about the advantages of a digital shekel as an open ended question, with the responses grouped. The answers were dominated by usability and convenience. On the disadvantage side, hacking and cyber attacks were the biggest concern. Other highly rated concerns were that usability might be poor, or that it wouldn’t be accessible for the elderly.

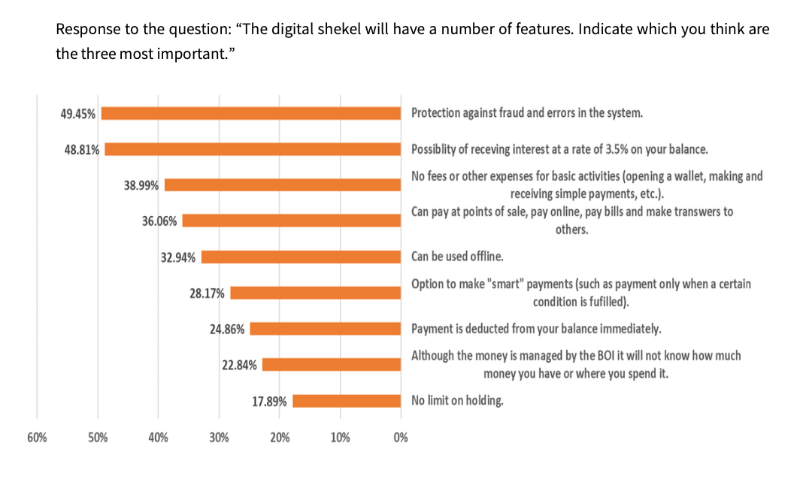

Then the survey turned to specific features of a digital shekel. The two that dominated were protecting against fraud and errors (49%) and the potential to receive interest at a rate of 3.5%. Yes, Israel is considering remunerating its CBDC, although it previously said this was unlikely at launch. It wants banks to become more competitive and responsive to customers.

The thoughtful aspect of the survey was it was split into two parts performed at different times with the same set of people. One survey collected demographics and general interests, and the other was dedicated to the digital shekel. The favored features mentioned above were prevalent across demographics.

Demographic differences for CBDC

One finding was particularly interesting. Those who own or previously owned cryptocurrencies were quite a bit more likely to favor the CBDC (69%) compared to those who have never owned crypto (50%). This is not what might be expected from hard core crypto users. One could argue that crypto investors see the value of digital currency and perhaps are less anti-establishment than one might expect.

As stated, the key demographic finding was that older people were more interested than younger. Amongst the youngest group (18-29), only 43% showed high interest, compare to 64% amongst those aged 60+. Men were more in favor than women. And more technology literate people were quite a bit more interested (68%) than the less tech savvy (43%).

Higher income people were more likely to be very interested as were those with greater financial literacy, but the difference was not significant.

Some time back, Israel said it was most likely to issue a CBDC if one were issued in the United States or Europe. A US CBDC is now off the cards for many years, but Europe is looking likely, assuming it gets legislative approval.

If you’re a regular Ledger Insights reader, there’s likely a feature you’d like to see us add, or something that bothers you that we can fix. We want you’re feedback, good or bad! Please take a minute or two to answer this short survey.