At a Congressional hearing this week, U.S. Congressman Bill Foster quizzed the Chair of the Federal Reserve, Jerome Powell, about the speed at which the Federal Reserve is exploring a central bank digital currency (CBDC) or digital dollar. Foster highlighted that even though cash is currently heavily used, the switch to digital payments can happen very rapidly.

Powell said the Fed appreciates the importance of making quick progress and acknowledged that Libra was a wake up call that a widespread alternative currency could happen in a short timeframe. Nonetheless, the Fed has not decided to proceed with a CBDC.

Additionally, Congressman Foster raised concerns that Libra, big tech and the Chinese government can roll out a digital currency rapidly. And China, as previously highlighted by Ledger Insights, could extend the currency to Belt and Road nations.

While Powell said he had visibility into the progress of the digital renminbi, the idea of having a ledger with everybody’s payment details might be acceptable in China, but would not be attractive in the U.S.

Separately, to encourage research and public discussion the former Chair of the Commodity Futures Trading Commission (CFTC) J. Christopher Giancarlo has set up the non-profit Digital Dollar Foundation in conjunction with Accenture

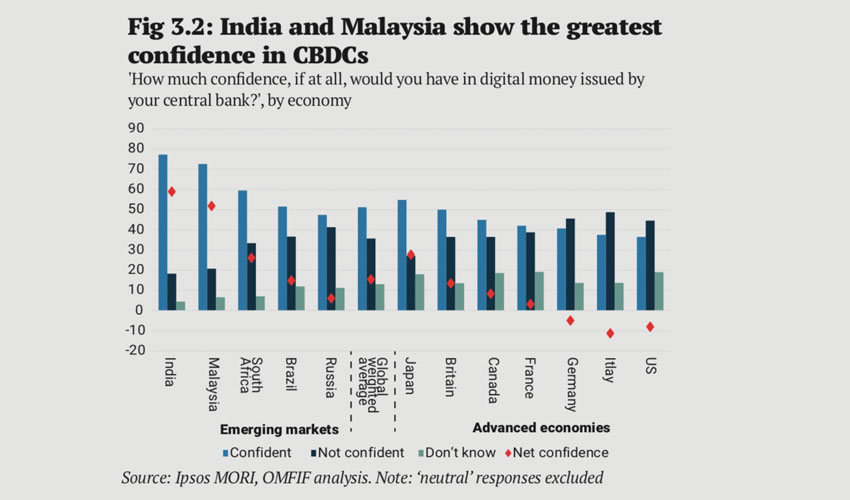

For now, it seems the public may not be keen. Recent consumer research by central bank think tank OMFIF and Ipsos MORI found a lack of public support for a U.S. CBDC. This contrasted with emerging markets where citizens are very keen.

The Bank for International Settlements (BIS) surveyed 66 central banks and found that 80% of the world’s central banks are exploring digital currencies and 10% have reached the pilot stage.

With respect to a threat to the dollar’s global dominance, the IMF’s chief economist does not believe digital currencies are a threat.

Transcript of comments by Congressman Foster and Federal Reserve Chair Powell

Foster: In a speech last week, Governor Brainard highlighted “the role of central bank digital currencies in ensuring that sovereign currencies stay at the center of each nation’s financial system.” Do you agree with her characterization? In particular, do you think that establishing a digital dollar would help ensure that the U.S. dollar continues to serve as the core of the U.S. and the world’s financial system?

Powell: To take the first part of that. I think that having a single government currency at the heart of the financial system is something that has served us well, it’s a very very basic thing, it really hasn’t been in question.

And I think before we move away from that, we should really understand what we’re doing. Preserving the centrality of a central, widely accepted currency, that is accepted and trusted is an enormously important thing.

I think whether a digital currency moves along that path or not is an open question. As you know, every major central bank is currently taking a deep look at that. We feel that that’s our obligation. Technology has now made this possible. The private sector is innovating. They’re doing it. So I think it’s very much incumbent on us and other central banks to understand the costs and benefits and trade offs associated with a possible digital currency.

Foster: How would you characterize your state of progress on this compared to other countries? The Swedish central bank (is) developing an e-krona, the Chinese. One of the reasons there was so much concern about the Libra project is that they would immediately have scale if they just rolled out the project.

Another entity in a position to do that is the Chinese government. To roll out at scale using their already established payment by cellphone systems. They would immediately have a scale comparable to Facebook if they rolled that out. So how would you characterize our ability to respond to this potentially competitive threat?

Powell: We’re working hard on it. We have a lot of projects, a lot of efforts going on on that right now. We haven’t had the problem that many have mentioned, Sweden. A lot of the Northern European economies have moved away from cash to a remarkable degree. And that really has not happened in the U.S. economy, even though it seems like it must have happened with our kids not using cash very much. Nonetheless, the amount of cash in the U.S. economy continues to grow at faster than nominal GDP.

Foster: If you look at the curve of adoption of payment by cellphone, it starts slowly. Then all of a sudden, it just happens. So it seems like that transition can happen in a period of just a couple of years. So we have to be able to respond. If that’s the driving factor, we have to be in a position where we can respond, for example, by rolling out a digital dollar in a couple (of years), your timescale?

Powell: I completely agree with that. And frankly Libra lit a fire under that and was a bit of wake up call that this is coming fast and could come in a way that is quite widespread and systemically important. Fairly quickly, if you use one of these big tech networks like Libra did. So we’re working hard on it. We fully appreciate the importance of making quick progress.

We have not decided to do this though. There are many questions that need to be answered around a digital currency for the United States. Cyber issues, privacy issues, many many operational alternatives present themselves. So we’re going to be working through all of that and doing that thoroughly and responsibly.

Foster: Do you feel as though you have adequate visibility into what the Chinese are doing on this? Do you have, sort of, working level contacts that give you some idea of what their roll out is likely to do, likely to look like?

Powell: Yes, we certainly have that. But we’re in a completely different institutional context. For example, the idea of having a ledger where you know everybody’s payments. It’s not something that would be particularly attractive in the United States context. It’s not a problem in China.

Foster: From a competitive point of view, they’re claiming they’re going to roll it out in a Belt and Road context sometime very quickly. So I urge you to keep the fire lit.

Later on (2.05) Congressman Hill asks about legislation to enable a CBDC and payment provider licenses.