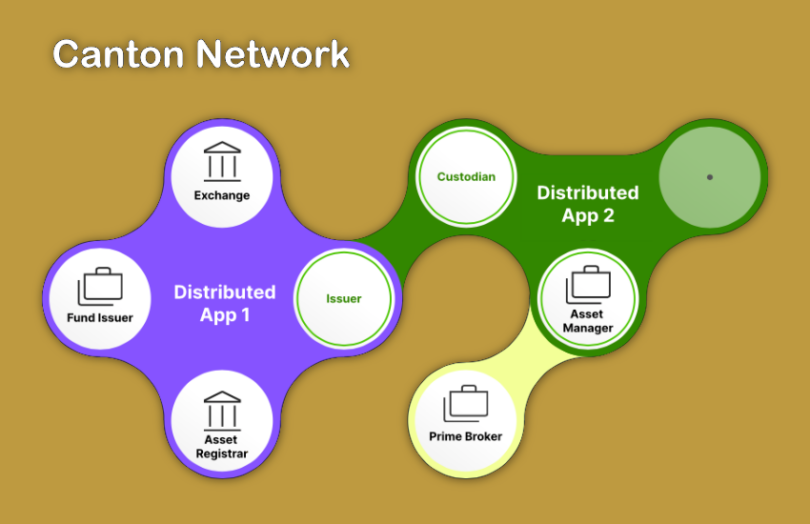

Earlier this year Digital Asset revealed that 45 institutions had participated in a DLT interoperability trial of the Canton Network since August last year. To date institutions have built siloed DLT networks, which desperately need to be linked in order for tokenization to achieve its potential. Today Digital Asset launched the ‘Global Synchronizer’, the decentralized infrastructure that enables the Canton Network. It includes the Global Synchronizer Foundation to govern the project, 32 participants, plus a utility coin for the public permissioned network.

Several big names are involved in the launch. They include Broadridge, Calastone, Cumberland DRW, Equilend, SBI Digital Assets, Tradeweb and Standard Chartered’s Zodia Custody. The 32 participants have a variety of roles, including as super validators, node operators, governance members and organizations running applications on the network. Some of the big banks and stock exchanges involved in previous network tests aren’t among the first wave of participants.

Stepping back, numerous initiatives are exploring how to address interoperability for tokenization in regulated financial markets. They include the Unified Ledger concept, Singapore’s Global Layer One (GL1), the Regulated Liability Network and its U.S. cousin, the Regulated Settlement Network. In each case, one primary technology is likely to be used. The Global Synchronizer likewise can offer a single network where applications can be deployed using Digital Asset’s technology.

Linux Foundation involvement

The Linux Foundation is involved in two aspects of the project. The Global Synchronizer Foundation is an independent U.S.-based entity that aims to govern the project in a decentralized manner. The foundation will be supported by the Linux Foundation to ensure neutral governance.

Additionally, Digital Asset is open sourcing the Global Synchronizer as an incubation Hyperledger Lab, Splice. The aim is to encourage iterations in the technology. There could be a network for a particular area, such as fixed income, allowing others to deploy separate networks.

In true decentralized fashion, the Global Synchronizer has a utility token, the Canton Coin. Usually coins are minted by validators, but in this case they can also be minted by application developers, incentivizing participation in the network.

The DLT interoperability challenge

Common networks ensure interoperability between applications on that network and using the same technology. However, one of the remaining issues is resolving interoperability between different technologies. For example, the RLN in the UK is based on R3’s Corda. The GL1 is likely to use Hyperledger Besu, although that remains to be seen. Hyperledger has multiple interoperability initiatives, but we also note the presence of Ownera as one of the 32 participants. It provides a routing network between DLT platforms and is technology agnostic.

The timing of today’s announcement is likely in preparation for the Point Zero Forum starting today, where the future of tokenization is a major topic.

The 32 participants are: 7RIDGE, Bitwave, Brale, Broadridge, Calastone, Copper.co, Cumberland DRW, Dfns, Digital Asset, EquiLend, Global Blockchain Business Council, Gravity Team, Hashnote, Hidden Road, Hydra X, InfStones, IntellectEU, Kaleido, LendOS, Liberty City Ventures, MPCH, Obsidian Systems, Ownera, QCP, SBI Digital Asset Holdings, Taurus, The Tie, Tradeweb, Validation Cloud, XBTO, XVentures, and Zodia Custody.

Update: Global Synchronizer Foundation as not an official Linux Foundation (LF) project, the neutral governance is supported by LF. Splice is a Hyperledger ‘lab’ incubation ‘project’.