During June and July, Digital Asset and the DTCC conducted a pilot with several other market participants to tokenize Treasuries for use as collateral. One of the key advantages of blockchain is the ability to support intraday transactions, which makes tokenized Treasuries the perfect collateral for margin calls.

While there are $2 billion in tokenized Treasuries on permissionless blockchains, by contrast these trials involved the public permissioned Canton Network connected to the DTCC’s LedgerScan.

A key challenge is most collateral takes time to transfer, whereas using blockchain it can be instant and 24/7, hence the intraday applications.

With the large institutions involved in the trials, $2 billion is a potential rounding error if such a solution were to go into production in the $25 trillion US Treasury market. The pilot involved a total of 26 firms, including the DTCC and two other financial market infrastructures, four banks and three custodians.

“This pilot successfully demonstrated the power of tokenization – and its potential to enhance collateral mobility and unlock liquidity,” said Nadine Chakar, Global Head of DTCC Digital Assets.

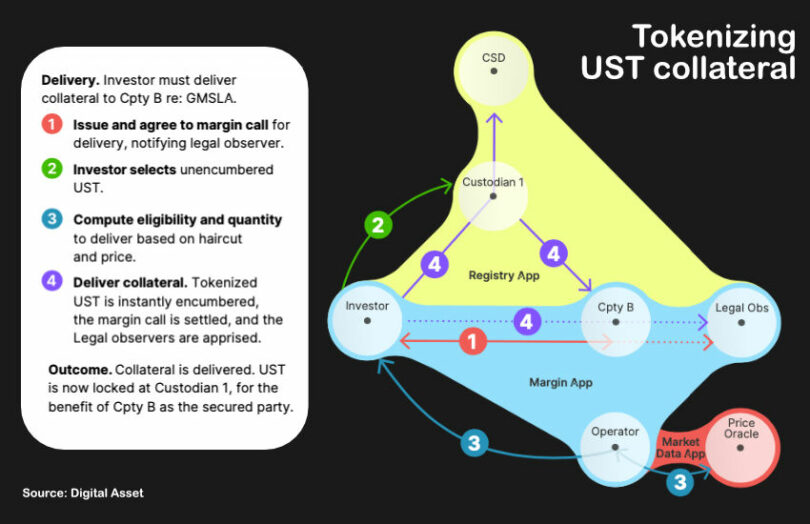

The first step in the process involved investors instructing custodians or collateral agents to lock their assets and tokenize them. Then the tokenized collateral was used to meet margin calls. Subsequently, the margin was released and the collateral returned. Apart from everyday operational steps, the pilot also explored defaults in which the pledged collateral is seized. That’s not just a technical issue, it’s also a legal one.

DLT works for collateral defaults

“Collateral isn’t just about mitigating risk—it ensures that in the event of a default, secured parties can take legal possession of the collateral. This demonstrates blockchain’s potential to support the full lifecycle of financial transactions, beyond just execution,” said Jenny Cieplak, a partner at law firm Latham & Watkins.

She continued, “Article 12 and the revisions to Article 8 of the Uniform Commercial Code start to establish a framework for using distributed ledgers to represent securities interests in the indirect holding system, which is where the vast majority of securities transactions take place today. Blockchain represents the next step in the evolution of securities books and records maintained by broker-dealers, much the way record-keeping previously evolved to cloud-based platforms.”

Collateral and collateral used in repo are active areas for DLT development. In Europe HQLAᵡ, backed by several global banks, has enabled European collateral mobility in partnership with the Deutsche Börse, and is also preparing to launch a repo solution. JP Morgan also has its Tokenized Collateral Network. And both JP Morgan and Broadridge have DLT-based repo platforms that use tokenized collateral.