Yesterday, Deloitte published it’s annual ‘Global Blockchain Survey 2020’ studying the investment and development trends in blockchain technology. It found that 39% of respondents had already put blockchain into production, compared to 23% in 2019. The production figure was even higher at 46% for organizations with more than $1 billion in revenues.

Deloitte surveyed a sample of 1,488 senior executives across 14 countries over a month ending March 3rd. So in many regions, this represents a pre-COVID-19 perspective.

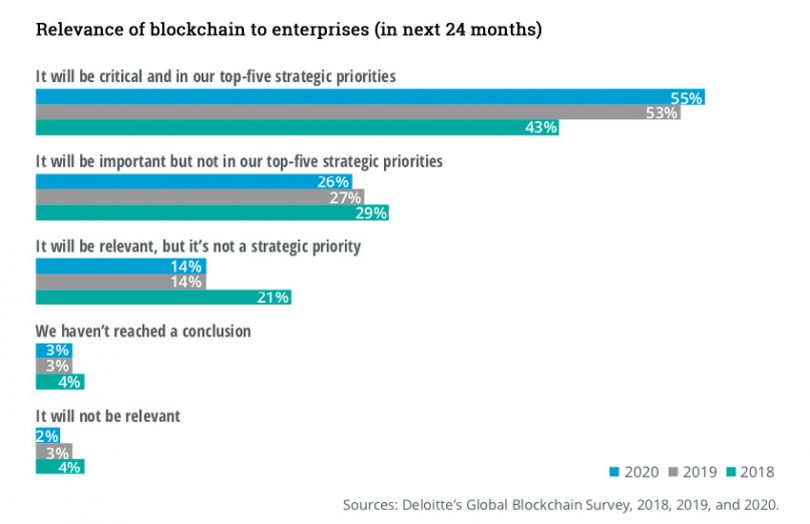

The company said that “organizations appear to be more committed than ever” to blockchain. This was affirmed by 55% (2019: 53%) of respondents saying blockchain is critical and in their top-five strategic priorities.

“This year’s survey suggests that blockchain is solidly entrenched in the strategic thinking of organizations across industries, sectors and applications,” said Linda Pawczuk, Principal, Global and U.S. Consulting Leader for Blockchain and Digital Assets, Deloitte Consulting LLP.

The survey also observed a slight change in attitudes towards blockchain, with more positive feedback. 83% of the respondents said they would lose a competitive edge if they don’t adopt blockchain, up from last year’s 77%. Meanwhile, 88% believe blockchain is highly scalable and will eventually become mainstream.

However, some respondents are still skeptical about blockchain, and 54% said blockchain is overhyped, compared to last year’s 43%.

While global adoption has increased, as demonstrated by the 16% rise in production blockchains, country-wise adoption figures broadly differ. In the U.S., 31% of the respondents said blockchain is in production, compared to China, where the value is nearly double at 59%. The APAC region stood at 53%.

Digital Assets

This year’s survey also sheds some light on digital asset adoption and their role in global commerce. Deloitte found that 89% of the survey respondents said digital assets would be very or somewhat important for their business in the next three years. And 83% believed digital assets would serve as an alternative or outright replacement for fiat currency in five to 10 years.

However, the problem is the lack of a clear consensus on how digital assets will be used. As companies develop use cases and adopt digital assets, the most significant problem areas are new tax and regulatory compliance structures. But companies are unfazed by this, and some 80% claimed they were prepared to deal with regulatory aspects of digital assets.

Although digital assets are often associated with cryptocurrencies, they are more diverse and can be used for a variety of purposes. Respondents who considered digital assets in their business models were most focused on enterprise controlled (64%) followed by general asset-backed (63%). Cryptocurrency comes at number three, with 59%.

“Our survey confirms what we see in the marketplace — a proliferation of digital assets used as a means of exchange, a store of value, digital representations of specific assets, or equity in a company,” said Rob Massey, Partner, Global and U.S. Tax Leader for Blockchain and Digital Assets, Deloitte Tax LLP.

Other considerations

Along with regulatory uncertainty, 58% of respondents said cybersecurity was also impacting their blockchain and digital asset strategy. Meanwhile, 21% said cybersecurity was the only hindrance to advancing their blockchain and digital asset strategy.

The top seven use cases were adopted by between 27% and 33% of respondents. In order of popularity, they were digital currency, data sharing, data reconciliation, identity protection, payments, track and trace and asset protection.

The Deloitte survey also explored the use of global digital identity, and 63% said it was vital to move forward in the blockchain space. Among the applications of digital identity, global financial transactions (29%) and data privacy (27%) stand to benefit the most.

Meanwhile, the blockchain consortia model is being explored to help address complexities in blockchain adoption. The 2020 survey studied the issues faced by enterprises when joining a consortium. The most prominent challenges for 41% of the respondents were the inability to create fair and balanced governance rules and poorly defined roles and responsibilities of members.

Recent blockchain surveys:

Accenture: blockchain for aerospace

Arthur D. Little / BITA: blockchain in transport

Boston Consulting Group: blockchain for transport and logistics

Cap Gemini blockchain survey

Deloitte 2019 blockchain survey

Deloitte 2018 blockchain survey

EY blockchain (finance and tech professionals) survey

EY fintech adoption survey

EY APAC blockchain survey

IDC semi-annual enterprise blockchain forecast

IHS Markit survey

Juniper enterprise blockchain survey

KPMG technology industry innovation survey

PwC blockchain survey

PwC China blockchain survey

SAP blockchain survey

World Energy Council / PwC blockchain survey

WIPRO blockchain survey

Capital Markets & Digital currencies:

Swiss Stock Exchange trader survey

TD Bank payments industry survey

BNY Mellon payments survey

State Street digital asset custody survey

Friss insurance survey

BIS Central Bank Digital Currency survey

OMFIF/Ipsos Mori Digital Currency consumer survey 2020

IBM / OMFIF Central Bank Digital Currency survey 2018

IBM / OMFIF Central Bank Digital Currency survey 2019

ING general population cryptocurrency attitudes