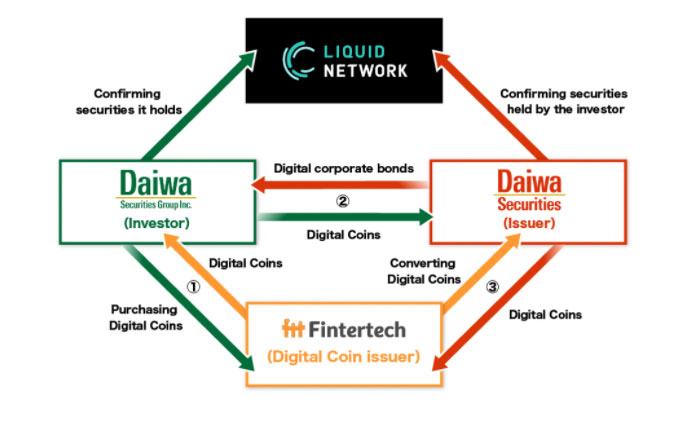

Today Daiwa Securities announced a proof of concept bond issuance on the Bitcoin network. Specifically, the tokenized debt was issued on the Liquid Network sidechain, which unlike the Bitcoin main chain, enables confidential transactions, identity verification and two-minute settlement.

The transaction also involved the tokenization of digital coins used to settle the payment in a delivery versus payment (DvP) transaction.

Two sets of bonds were issued by Daiwa Securities (Yen 10 million) and Daiwa Food & Agriculture (Yen 1 million). In both cases Daiwa Securities Group was the investor. The bonds mature on March 26.

Daiwa subsidiary Fintertech acted as the digital coin issuer on the Liquid Network. The aim is to use these coins to pay interest and repay the debt at maturity. Crypto Garage was the technology partner for the test.

“We believe this will lead to the securitization of assets that were previously not securitized, as well as greater efficiency in the securities distribution market,” said Daiwa Securities.

Apart from this, Daiwa Securities is planning to research security token offerings (STO).

This isn’t the first corporate to test bond issuance via a public blockchain. But it’s the first we’re aware of using the Bitcoin network.

Société Générale has issued multiple bonds on Ethereum, including a test for €40 million where a central bank digital currency (CBDC) issued by the Banque de France was used for payment. Santander also issued a bond on Ethereum.

Note: Ledger Insights authors and management do not own any Bitcoin