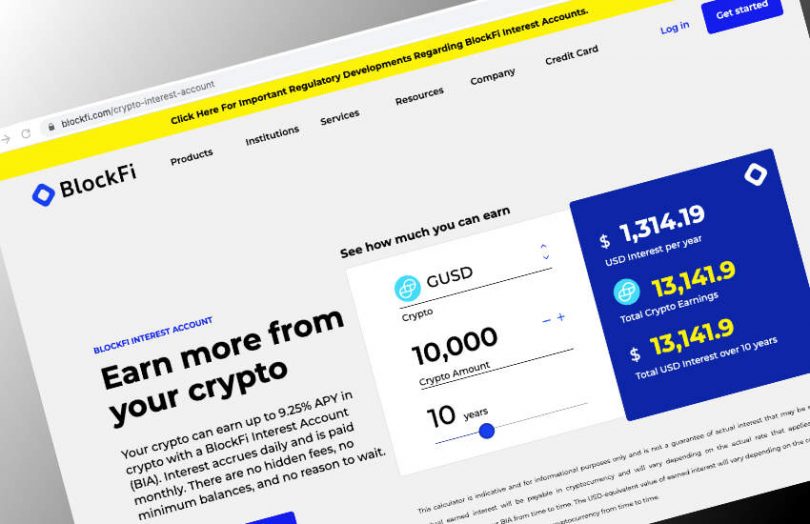

Today the Securities and Exchange Commission (SEC) announced it had charged BlockFi Lending with securities breaches relating to its cryptocurrency lending activities. The startup agreed to pay a penalty of $50 million to the SEC and another $50 million to 32 state regulators. However, BlockFi intends to register with the SEC for a new “BlockFi Yield” offering, a regulated security.

Talking about the new “BlockFi Yield” plans, the founders said, “With today’s resolution, we are leading the creation of a new regulatory landscape for crypto and our clients.”

Since Gary Gensler took office as Chair at the SEC, he has argued that crypto lending services are securities. Last year, when cryptocurrency exchange Coinbase revealed plans for its cryptocurrency lending product, the SEC apparently stated that crypto lending is an unregulated security and Coinbase did not proceed.

In today’s agreement, the SEC censured BlockFi on three counts. Firstly that its retail crypto lending product is an unregulated security. Secondly, it violated the registration provisions of the Investment Company Act of 1940. That’s because it is not registered as an investment company but issued securities. Plus, more than 40% of its assets apart from cash were held in investment securities, including loans to institutional borrowers.

And thirdly, the SEC found that the website contained misleading statements about the level of risk associated with its lending product.

Existing BlockFi U.S. clients can continue to earn interest on their existing products but cannot add new assets. And it cannot open new accounts in the United States, although it does not impact its activities elsewhere.

What about the rest of the sector?

Until last year, BlockFi was seen as the leading crypto lender, both in terms of volumes and quality. It is backed by high profile venture capital firms such as Bain Capital and Tiger Global and was the first to register with state regulators, although several states initiated cease and desist actions last year. BlockFi states that its current assets under management are just over $10 billion, down from almost $15 billion at one point.

In the meantime, two other centralized crypto lenders, Celsius and Nexo, appear to have overtaken BlockFi. Both were initially funded via large 2018 ICOs, which lack the due diligence involved in venture funding.

Celsius has recently raised significant funding from a small number of investors. In June 2020, Celsius received its first equity $10m investment from controversial stablecoin Tether, and was also loaned $1 billion by Tether. Late last year, Celsius’s then CFO was arrested over an alleged crypto scam at a previous employer. Despite this, Celsius appears to be the current market leader in terms of lending volume, claiming to have almost $20 billion in assets under management.

It remains to be seen what’s next for blockchain decentralized lending protocols. If the centralized lending products are considered securities, then the DeFi ones probably would be as well.

In some ways, the transparency of the DeFi protocols such as Aave and Compound makes the lending side lower risk, provided there’s no centralized control over keys. Apart from the key issue, there’s a lower risk of a Ponzi scheme. But there are technical risks, such as bugs in smart contracts. Some argue that these DeFi protocols are more automated than decentralized because an organization is responsible for the code. And those organizations might become SEC targets.