Genesis Trading, one of the largest OTC traders and crypto lenders for accredited investors, has received a bailout from its owner, Digital Currency Group (DCG). The cause was the default of failed crypto hedge fund Three Arrows Capital. Yesterday, Genesis CEO Michael Moro, clarified the situation after previously stating that the company had mitigated losses from a defaulting borrower.

“We worked with DCG to find the optimal strategy to further isolate the risk. DCG has assumed certain liabilities of Genesis related to this counterparty to ensure we have the capital to operate and scale our business for the long-term,” said Moro via Twitter.

It’s conceivable that one of DCG’s other subsidiaries, Grayscale, may have contributed to Three Arrows’ problems.

Moro confirmed the defaulting lending counterparty was Three Arrows Capital and that it had a margin requirement of over 80%, and its collateral was quickly liquidated. However, the size of the loan and the loss were not shared and must have been significant.

At the end of March, Genesis had $14.6 billion in active loans with $44.3 billion in loan originations during the quarter. Within the same period, it traded $27.8 billion in notional value of derivatives and $11.4 billion on the spot market. This means lending was a massive part of its activity.

Grayscale GBTC discount part of the problem?

While Three Arrows Capital was thought to have lost large sums after the collapse of the Terra algorithmic stablecoin and the crypto crash, some have speculated that its massive investment in Grayscale Bitcoin Trust (GBTC) – Grayscale is owned by DCG – contributed of the problem. However, it’s unclear whether it still owned the 38.888 million DCG shares it held at the end of 2020. At that time, they were worth $1.2 billion, but today would be valued at $489 million.

If Three Arrows had invested in spot Bitcoin, the loss would have been $348 million rather than $711 million. That’s because GBTC was trading at a 17% premium when Three Arrows disclosed its holding in an SEC filing, whereas today, the Bitcoin Trust is trading at a 33% discount. Grayscale is keen to convert the closed end trust to an ETF to try and close that gap, but the SEC has declined approval. Grayscale has sued the SEC and yesterday the Wall Street Journal published an editorial board piece supporting its position.

Other Crypto Crash news

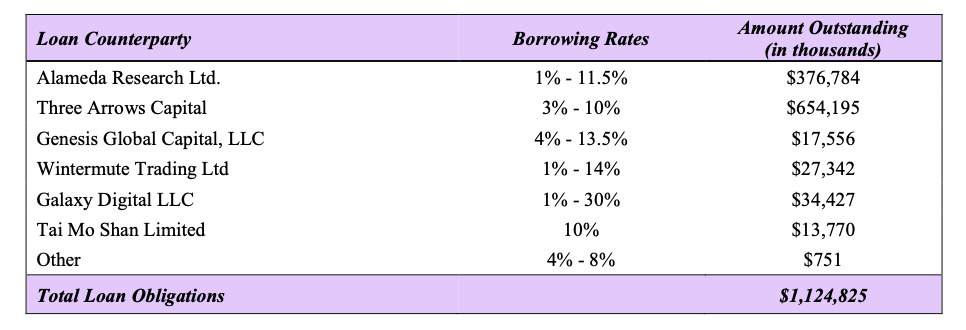

Several other lenders were impacted by the Three Arrows collapse, including Voyager, which went into Chapter 11 this week. Yesterday we reported Sam Bankman-Fried’s Alameda Research was the biggest unsecured debtor at $75 million. However, it turns out that Alameda borrowed money from Voyager and currently owes it $377 million.

This is from one of yesterday’s filings that can be downloaded here.

Meanwhile, BlockFi was bailed out by Sam Bankman-Fried’s FTX.US on Friday. Three Arrows was ordered to liquidate in the British Virgin Island, and its US subsidiary requested Chapter 15 bankruptcy protection.