Today the Bank for International Settlements (BIS) Innovation Hub outlined its roadmap of work with central banks, which includes several central bank digital currency (CBDC) projects as well as a distributed ledger technology (DLT) solution for retail green bonds.

Four projects were outlined, two are new initiatives and three are for wholesale CBDCs or bank to bank usage.

Retail CBDC

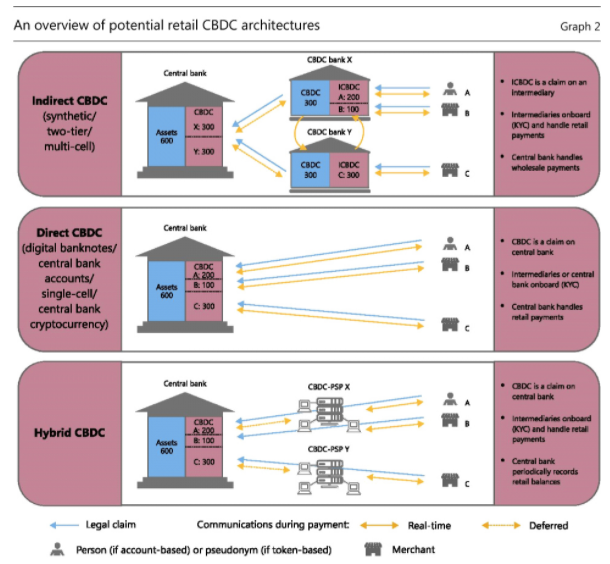

The upcoming retail project will be based in Hong Kong and is focused on the tiered distribution of a retail CBDC via banks and payment service providers. Plans involve trialing a hybrid CBDC as well as private CBDC-backed stablecoins. Below is a BIS graphic published last year on different types of CBDC.

Based on comments by the former Governor of the People’s Bank of China, we’d position the digital yuan or eCNY as an Indirect CBDC. It’s also notable that the Hong Kong Monetary Authority is progressing work on the digital yuan for cross border payments.

Wholesale CBDC

Turning to wholesale CBDCs, the first is the ongoing Project Helvetia experiments with the Swiss National Bank, where there was a trial to connect the SIX Digital Exchange with a wholesale CBDC to enable instant settlement for blockchain transactions.

Next is a platform to settle cross-border payments using multiple wholesale CBDCs. This new project is for an international settlement platform onto which multiple central banks could issue wholesale CBDCs. The aim is for banks and payment service providers to use this for settlement purposes.

We note this project’s location in Singapore, where there is another project to commercialize work by the Monetary Authority of Singapore. In this other project, JP Morgan, DBS Bank and state-owned investment firm Temasek are creating a blockchain-based clearing and settlement network for wholesale payments, which will initially focus on domestic multi-currency payments and is looking to onboard other Singapore banks. We reached out to see if this project is involved in the BIS Innovation Hub work and it is not. A spokesperson for the non-BIS initiative commented that “Both projects have similar beginnings and we are happy to continue to contribute and support the global work on CBDCs.”

Another Innovation Hub project is a Multiple CBDC bridge for cross border fund transfers and real-time atomic settlement of foreign exchange transactions. It also plans to create a prototype for a cross border corridor network. This is an ongoing initiative based in Hong Kong which builds on the work between the Bank of Thailand and Hong Kong Monetary Authority called Project Inthanon-LionRock. CryptoBLK was previously the partner on the Thai side using R3’s Corda. But for the latest Inthanon-LionRock iteration, ConsenSys is working with both sides using Ethereum.

Although the BIS Innovation Hub has set up several new centers around the world, these programs are focused on the existing hubs in Switzerland, Singapore and Hong Kong. An Innovation Hub network has also been created to involve all 63 BIS central bank members, not just the ones with Hub centers.

Update: Confirmation that the JP Morgan, DBS Bank, Temasek project is not associated with the Singapore BIS Innovation Hub was added.