Yesterday cryptocurrency exchange Coinbase debuted on the Nasdaq stock market, closing at $328.28, valuing the company at $84 billion. Instead of an initial public offering, the company opted for a direct listing without issuing any new shares.

How does the stock price compare to private market prices before the listing? According to Coinbase, for the first quarter through to 15 March 2021, the weighted price was $343.58.

Some large institutions don’t hold Bitcoin cryptocurrency directly, so they look for surrogates such as futures, ETFs (which don’t yet exist for bitcoin in the U.S.) or stocks with a high correlation to the Bitcoin price. For example, software company Microstrategy borrowed significant sums to buy Bitcoin and hold it on its balance sheet. A large proportion of its price is linked to the price of Bitcoin. Since that move, 38% of its stock has been acquired by Blackrock, Morgan Stanley, and Vanguard.

Going forward, Coinbase is likely to feature strongly in these sorts of portfolios.

How does Coinbase’s valuation compare?

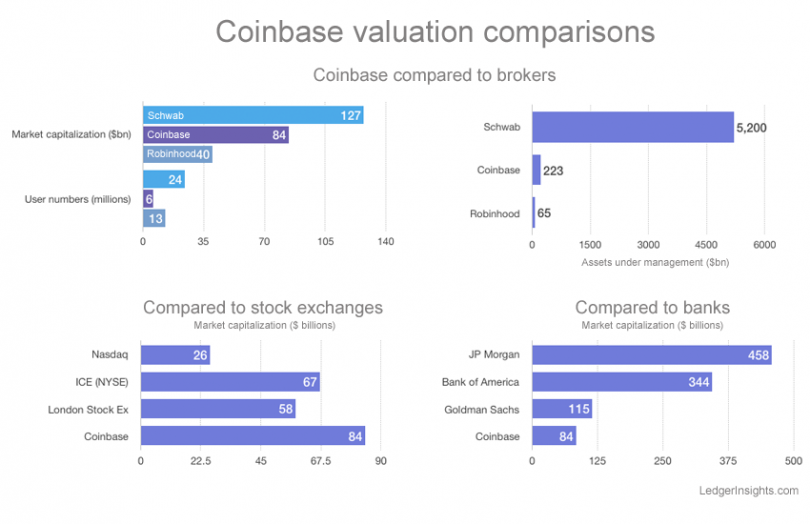

Quite a few different market capitalization figures are floating around for Coinbase. The reason is whether you only count the issued shares (186 million) or you include all shares that will be issued under options and warrants (256 million). We’ve used the latter.

If one believes the narrative that digital assets are the future of finance, then the next question is how does Coinbase’s market capitalization compare and to what? In future, will it be the equivalent of a broker, a stock exchange, a bank or all of the above?

For fun, we put together the charts above.

Crypto is booming

During the current cryptocurrency boom, Coinbase is flourishing. However, the company itself highlights that its performance is linked to the Bitcoin price and crypto asset volatility.

Shortly before the IPO, the company released estimated figures for the first quarter of 2021, which showed massive growth. That’s not entirely surprising given the boom in cryptocurrencies and nonfungible tokens.

Topline revenues for the first quarter were $1.8 billion, up from $1.27 billion for the whole of 2020. Net income was estimated at $730 million to $800 million compared to $322 million for the whole of 2020. The company made a loss of $30 million during the 2019 crypto downturn.

Monthly transacting users more than doubled in the first quarter of 2021 at 6.1 million users, up from 2.8 million at the end of 2020. Verified users, a loose term for people that have ‘demonstrated an interest’ in Coinbase – went from 43 million in 2020 to 56 million at the end of this March.

Assets on the platform rose to $223 billion, up from $90 billion at the end of 2020.

One thing is likely for new Coinbase stock owners: Given the association with Bitcoin, they’ll be in for a wild ride.