Yesterday Clearstream, the DTCC and Euroclear jointly released a digital assets framework they developed in conjunction with Boston Consulting Group (BCG). BCG is the company that made the $16 trillion estimate of the digital assets opportunity by 2030. The three firms are the largest central securities depositories (CSDs) and central counterparties (CCPs) in the world. Last year they published a paper outlining how they can help industry to address the fragmentation that’s appearing in the digital securities sector.

They are currently responsible for recording most securities transactions. Hence, they have a critical role in the adoption of distributed ledgers.

“While many firms recognise that blockchain holds enormous promise to deliver cost savings, capital efficiencies and reduced risk, the industry needs to pivot and demonstrate tangible results and value generation,” said Nadine Chakar, Managing Director, Global Head of DTCC Digital Assets. “We have a unique opportunity to transform the financial system, but it will require collaboration across a wide cross section of firms.”

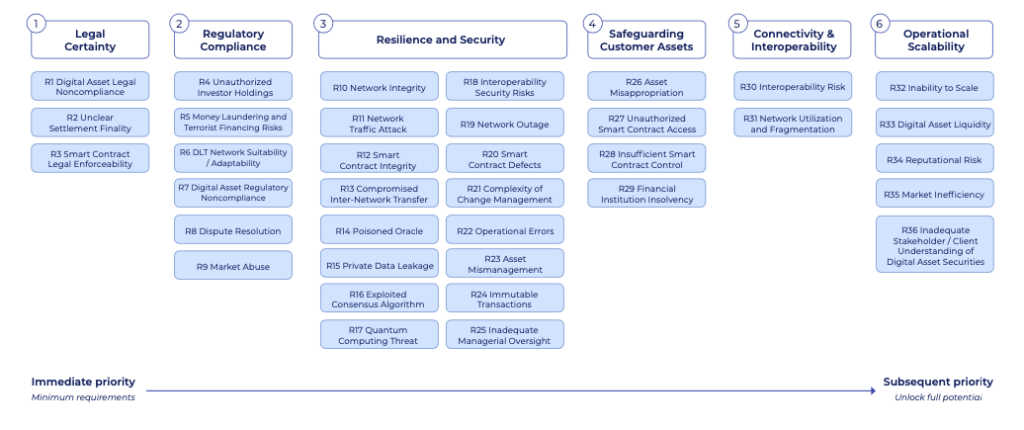

The “Building the Digital Assets Ecosystem” paper outlines six principles to ensure that tokenization is successfully adopted for digital asset securities, beyond cryptocurrencies.

Six principles for tokenization

At first the six principles look obvious, but there’s a lot of meat on the bone.

- Legal certainty – ensuring operations comply with law

- Regulatory compliance – encouraging alignment with regulatory frameworks

- Resilience and security – developing robust infrastructure capable of resisting disruptions while protecting sensitive data

- Safeguarding customer assets – implementing governance via smart contracts to manage assets securely

- Connectivity and interoperability – facilitating transactions and flexible settlements across diverse networks

- Operational scalability – striving for efficiency and cost-effectiveness through standardisation.

In some cases you’d assume regulated institutions would do all these things, but the devil is in the detail. Take legal certainty. Settlement finality may not be clear depending on the blockchain and jurisdiction. How much confidence will you have that smart contracts are enforceable?

On the regulatory compliance front, we’ve seen most regulated institutions insist on identifying users and implementing know your customer compliance. However, many asset managers are attracted to the reach of public blockchains. What about the maximum extracted value (MEV) on public blockchains that enables frontrunning? Regulators consider that as market abuse. While dispute resolution is nonexistent in the crypto world, it’s a regulatory requirement for securities.

“New technologies bear immense potential to bring financial markets to the next level of efficiency, speed and safety,” said Jens Hachmeister, Managing Director, Head of Issuer Services & New Digital Markets at Clearstream.

“To make this evolution a sustainable one, we need industry-wide collaboration and unified standards to overcome current challenges and drive the seamless integration of digital assets in the global financial ecosystem. As financial market infrastructures, we are developing the foundation for future digital markets for the benefit of our clients and all market participants.”