Tony McLaughlin, a 20 year Citi veteran who created the vision behind the Regulated Liability Network, is leaving to create a stablecoin-related startup. He is presently on gardening leave. The Regulated Liability Network (RLN) has the concept of a shared network where tokenized deposits, CBDC and regulated stablecoins coexist. It’s fair to say that the RLN also inspired the BIS concept of a Unified Ledger.

Given his position in this space, the burning question is what does he plan to do next?

A month ago Mr McLaughlin launched a website for his new venture, Ubyx, including a whitepaper which was promptly removed. Likewise a related Linkedin post was taken down. Hence, we wondered how long it would take for the resignation announcement. Fortunately, we downloaded the white paper before its removal and include an excerpt below.

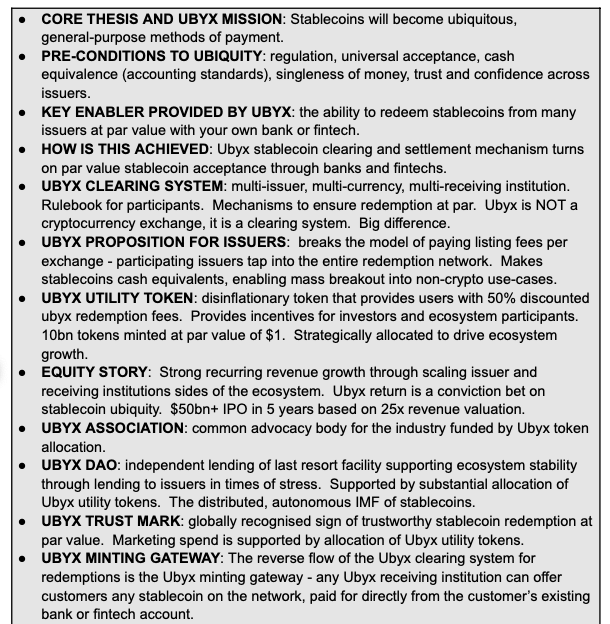

Ubyx: Helping stablecoins become ubiquitous

Ubyx is about the ubiquity of stablecoins. Today the redemption of stablecoins is via cryptocurrency exchanges or a few organizations with direct relationships with stablecoin issuers. Ubyx aims to expand that.

Mr McLaughlin wants to create a centralized global on and off-ramp for all regulated stablecoins. In other words, if you receive a stablecoin that you don’t want to hold, you can redeem it at your bank or a fintech. Likewise, you can mint any stablecoin you choose via your banking partner.

One analogy is comparing stablecoins to checks and Ubyx is the clearing system. An alternative is to view Ubyx as the Visa/Mastercard of stablecoins. In the same way that Visa and Mastercard enable bank payments via shops worldwide accepting their cards, Ubyx allows stablecoin issuers, including small ones, to be trusted for acceptance globally.

It gives banks a single path to redeem stablecoins from all participating issuers via an API.

Consider the promise of stablecoins for cross border payments. Not only would Ubyx make stablecoins far easier to use at a consumer level, but it would make them more accessible for corporates. If banks support stablecoins, then enterprises and institutions that don’t want to touch ‘crypto’ won’t need to handle wallet risks and the like. It also sidesteps the need for stablecoin issuers to pay cryptocurrency exchange listing fees. This supports smaller issuers who can’t afford millions for listings.

Stablecoins by nature encourage network effects. While many firms are currently starting to issue stablecoins, longer term, the number of stablecoins that survive is likely to be far fewer compared to the number of banks. However, something like Ubyx could allow smaller ones to survive and even flourish.

How it works

To satisfy redemption requests, in a few strategic locations issuers will maintain pre-funded bank accounts that count as reserves. When a stablecoin is redeemed, Ubyx debits the issuer bank account and pays the receiving bank account, with appropriate compliance checks.

Ubyx charges 20 basis points for redemptions (0.2%), but that figure is halved if the fee is paid with Ubyx tokens. There’s a limited supply of tokens which are burned when used to pay for redemptions, with the white paper outlining the tokenomics. Apart from minting tokens, Ubyx also plans to issue equity to venture capitalists and envisages an IPO at a potential valuation of $50 billion in five years.

It’s a big idea, and one that Mr McLaughlin is uniquely positioned to lead. If enough issuers and banks sign up, Ubyx could certainly accelerate the adoption of stablecoins.

Ubyx whitepaper excerpt

What does this mean for tokenized deposits?

We haven’t been able to chat to Mr McLaughlin given he’s on gardening leave. The burning question is how this reflects on the RLN and interbank tokenized deposits more generally. Mr McLaughlin unveiled the RLN concept in September 2021. More than three years on, it’s still in experimental phases in both the US and UK. Banks in neither jurisdiction have committed to a launch, which must be frustrating but perhaps not unexpected. Initiatives such as Partior for cross border payments are up and running, but not really at scale. Yet.

In the meantime, stablecoin infrastructure is moving forward in leaps and bounds, particularly with Stripe’s acquisition of Bridge. Some banks are starting to use stablecoins themselves. For example, the Japanese big three are planning to experiment with using stablecoins on the backend for cross border payments. So is Standard Chartered’s Zodia Markets.

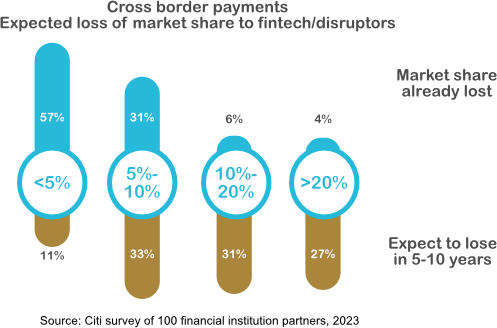

Despite the inroads of the likes of Wise and Revolut for cross border payments, today for the most part banks still own the customer interaction, especially for larger businesses. The question is: for how long? Citi itself surveyed institutions about the impact of challengers on cross border payments. Their views below look somewhat optimistic, with only 27% expecting an impact of more than 20%.