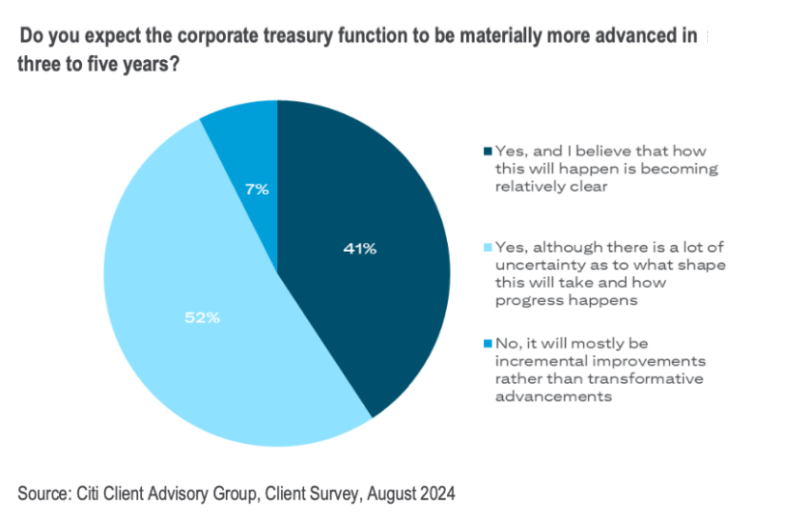

Citi GPS published a report, Treasury 2030, exploring what the future of the corporate treasury function might look like. A survey found that 93% of corporate treasurers think there will be big changes in the corporate treasury function in the next three to five years, but more than half are unclear about what those changes might look like. Two of the technologies that are likely to feature in the evolution are artificial intelligence (AI) and distributed ledger technology (DLT). However, a top current priority is improving access to data for decision making.

Two key changes are moving from batching to 24/7 activity, accompanied by automation driven by AI.

The report argues that the role of the corporate treasurer needs to expand beyond managing financial risk, cash and funding. Given that receipts and payments impact the cash balance and are increasingly in real time, they say that digital payment channels should fall into the treasurer’s remit.

A role for DLT and tokenization?

Citi envisions digital assets, blockchain and smart contracts playing a ‘pivotal’ role in 24/7 money movement. Smart contracts and tokenization enable programmable payments and automation. It mentions the Regulated Liability Network, a proposed infrastructure bringing together tokenized deposits, regulated stablecoins and CBDC onto a common network combined with programmability.

“AI technology has the ability to learn from previous payments to better identify cases of potential fraud. Smart contracts enable automation of certain processes and can eliminate costly 3rd party transactions. Digital identity solutions can help institutions ensure that only authorized individuals are executing transactions,” the authors wrote.

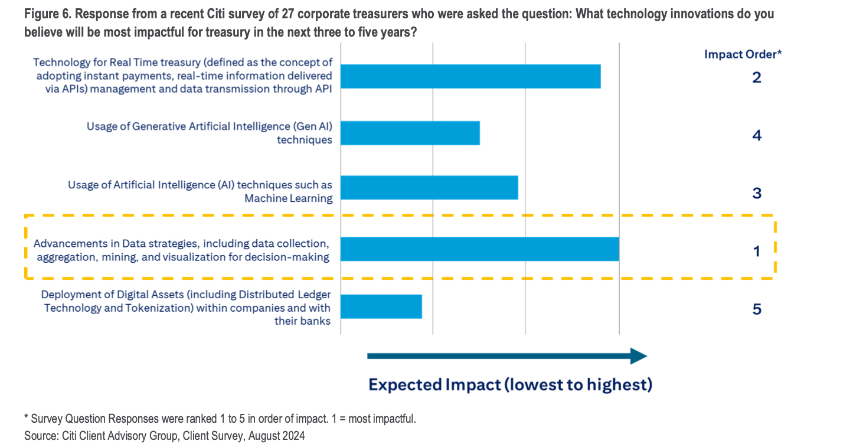

The bank surveyed 27 large corporate treasurers, asking them which technologies will have the most impact in the next three to five years. Data strategies and data collection are the top priority, with DLT and digital assets coming in fifth.

There’s an important point not raised in the report. Treasurers may need to deploy AI internally to learn from their data and assist with decisions. DLT is a back office technology so it’s possible to benefit from DLT and tokenization without being fully aware it’s even there. After all, treasurers don’t necessarily think about real time gross settlement (RTGS) systems. They think about payments, cash coming in, and the timing. However, if they wish to take full advantage of programmability, they might need to get their hands dirty.