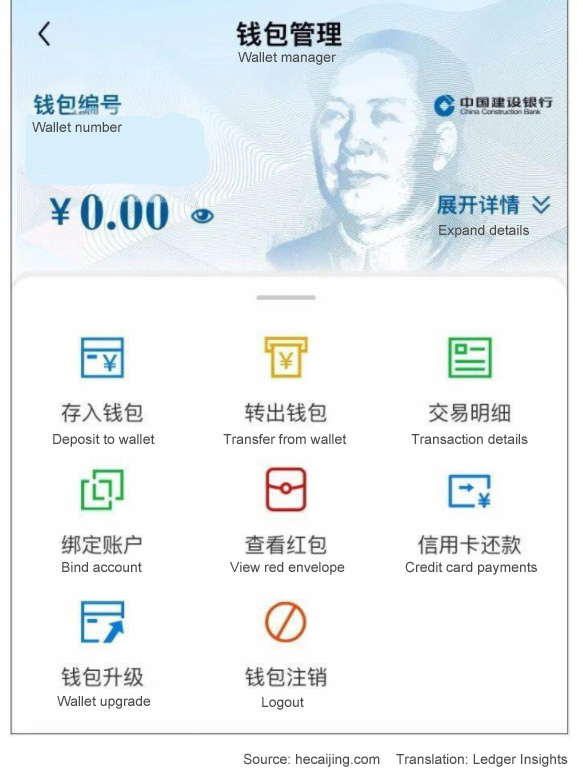

On Saturday morning China Construction Bank, one of the big four state banks, enabled open use of the central bank digital currency (CBDC) trial in its app. By the afternoon, the functionality for the digital yuan, also known as DCEP was disabled.

It was probably an oversight because in order to access the functionality, one had to search for “digital currency” in the app. Nonetheless, users could bind the wallet to their bank account and make transactions. The terms and conditions of the trial give the bank the right to reverse transactions.

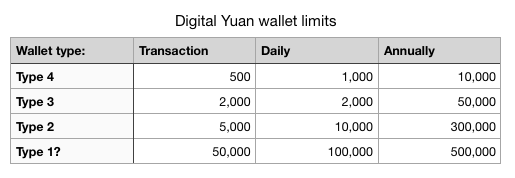

Apart from the latest screenshot, the main revelation was that there are four types of wallets, each with different transaction limits. It was previously revealed that there would controllable anonymity for the digital currency, but this might be more than that. One of the reporters stated that all they needed to do was link their bank account. But that automatically provides identity information.

Wallet types 1-3 are restricted to one per person per bank. The fourth type of wallet is the most restrictive with the maximum of 500 yuan ($73) per payment, a daily limit of 1,000 yuan ($146) and 10,000 yuan ($1458) per month. The reporting of the limits on the wallets was slightly inconsistent for the higher limits. Hence, we wondered whether the limits or the availability of some of the wallets may depend on the person.

At this stage the digital yuan is officially being trialed in four regions, Shenzhen, Suzhou, Xiongan New Area, Chengdu, and the Winter Olympics locations. The big four state banks are all involved in testing apps. In April, the first digital yuan wallet screenshot was revealed by an Agricultural Bank of China user.

Sources: Beijing Youth Daily, Sina Finance, CNBeta