Whether or not the Chinese renminbi (RMB) can challenge the dollar’s dominance is a matter of ongoing debate, including the role of China’s future central bank digital currency DC/EP. On Tuesday, the second largest firm in the world, state-owned China Construction Bank (CCB) published the “2020 RMB Internationalization Report” in conjunction with the Asian Banker.

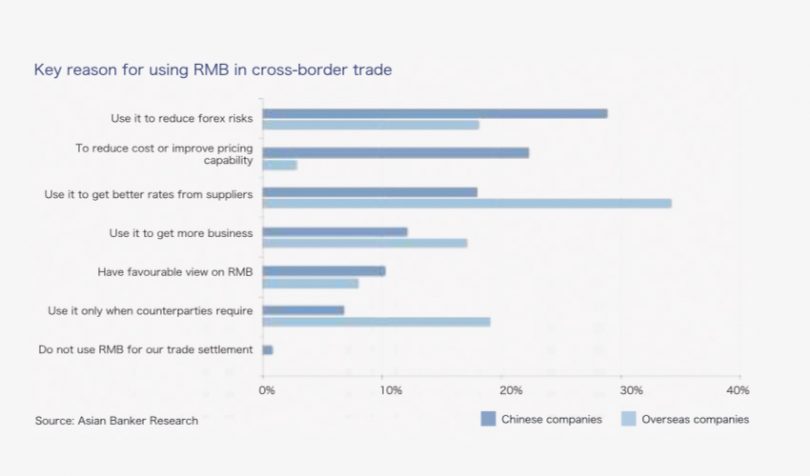

Based on a 2019 survey of 643 corporates and financial institutions, the CCB claims that 67% of overseas corporate respondents increased their use of the renminbi for cross border trade. The most common reason was to get better rates from suppliers (34%). Just 19% responded that the RMB motivation was because their trading partner required it, down from 47% in 2017.

Even if companies use the RMB for trade, that doesn’t mean it’s for every transaction. 76% of the overseas companies said more than 10% of their trade was in RMB.

Appetite for a central bank digital currency (CBDC)

The survey also asked about attitudes towards the People’s Bank of China (PBoC) issuing a digital yuan. 84% of Chinese corporates and 61% of overseas companies said the DC/EP would have a favorable impact on renminbi internationalization. In terms of the digital currency itself, 57% of Chinese firms and 55% of overseas companies were positive about it.

However, when it comes to whether they are willing to adopt the DC/EP, Chinese firms seem significantly less enthusiastic. Only 27% said they would use it, with 61% taking a wait and see stance. In contrast, 52% of overseas companies expressed a willingness to adopt the DC/EP.

The report doesn’t delve into the motivations behind Chinese corporate resistance, but we’ll speculate on the reasons. While the DC/EP will have controllable privacy, most trade transaction values will exceed regulatory thresholds. Hence they will be open to tighter government review for both tax and foreign exchange purposes, giving less wiggle room for Chinese companies to move cash offshore and escape government supervision.

One of the oft-cited reasons for the RMB to become a dollar challenger is the Belt and Road initiative (BRI). Trade with BRI countries increased by 10.8% to $1.32 trillion in 2019. China is the largest trade partner of 25 BRI countries and has signed currency SWAP agreements with more than 20 states. The report emphasizes that if these countries purchase equipment and services in RMB, they reduce their foreign exchange risk.

Commodities and financial drivers

In a recent U.S. Senate debate on central bank digital currency (CBDC), Chris Giancarlo of the Digital Dollar Project noted that most commodity markets and trades are denominated in U.S. Dollars. As those trades digitize, they need the dollar to be digital as well. In China, the Shanghai International Energy Exchange (INE) will launch a domestic copper contract that will be available to foreign participants, but denominated in RMB. China is the world’s largest copper consumer.

To date, the demand for RMB has primarily been driven by trade. But China is increasingly opening its capital markets, which could have a significant impact. The report mentions this as a driver and points to the London Stock Exchange tie-up, Shanghai London Stock Connect, which allows foreign companies to list in China and international investors can access China A-shares.

But it doesn’t mention some other high profile inward investment examples. Last year it was announced that restrictions on foreign ownership of financial firms would be lifted from 1 April 2020, which was subsequently confirmed. Goldman Sachs and Morgan Stanley announced they would increase the stakes in local joint ventures to 51%, and Goldman plans to seek full ownership. And this year, both Mastercard and American Express gained access to the payments market following PayPal’s entrance at the end of 2019. The moves will significantly increase exposures of the firms to the renminbi.

Plus, inward investments no longer have to apply to State Administration of Foreign Exchange (SAFE) for a currency quota. The investee’s custodian has to do the SAFE registration, so this is more of a friction reduction than a full relaxation. Some claim that controls have actually tightened.

It’s not all one way traffic in favor of the renminbi. The Wall Street Journal (WSJ) argued that the removal of foreign investment quota ceilings was not a big deal because the investment levels are significantly below the ceiling.

In another article, the WSJ pointed to declines in foreign direct investment in February. However, for China, that marked the COVID-19 peak, and there was a subsequent bounce followed by another decline. In 2019 the figure showed a growth of 5.8% despite a trade war. This year’s numbers are messy because of the virus, but the fallout from the pandemic remains to be seen. If countries follow through on the desire to move production closer to home, it will impact the renminbi.