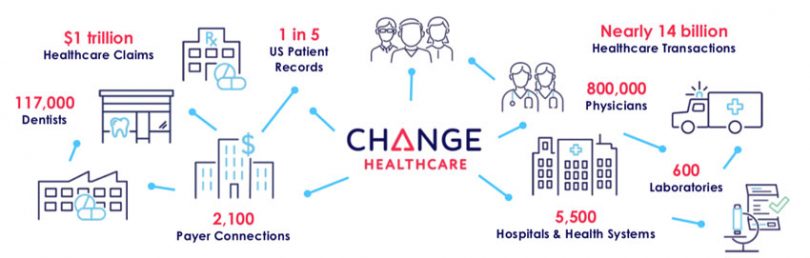

Change Healthcare runs a blockchain that processes thirty million transactions per day. The company plays a crucial role in the U.S. healthcare sector where it acts as a clearinghouse for insurance claims with both the healthcare providers and insurers as clients. In 2017 the business processed $1 trillion in claims. Putting that in context, in the same year U.S. healthcare expenditure was estimated at $3.5 trillion which accounted for 18% of GDP.

McKesson, the giant pharma distribution company (2018 revenues $208 billion) owns 70% of Change Healthcare. In mid-2016 McKesson merged its IT activities with the original Change Healthcare owned by Blackstone private equity. A year ago the Change Healthcare CEO announced a possible IPO and in October Reuters reported that McKesson had appointed underwriters. The IPO could value Change Healthcare at up to $12 billion.

Apart from claims settlement and payment, Change Healthcare provides software and analytics, clinical services including medical records and patient engagement services like consent management and digital identity.

But it’s the claims clearinghouse that’s the initial blockchain focus. In any blockchain solution to ensure adoption, it’s important to incentivize all the participants. For healthcare that means the patients, the healthcare providers, and the payers or insurers.

The need to share

While Change Healthcare doesn’t deal directly with consumers, its blockchain efforts could have a big impact on patients. When a patient needs medical care, the stress of the medical process is enough on its own without having to worry about how much the insurance policy will cover and what the final cost may be.

It can take 7 to 14 days to get results from an eligibility check to find out if a procedure will be covered by insurance. By storing some of that logic in a blockchain smart contract, there’s potential to reduce the response time to a matter of minutes for routine medical checks like mammograms. In some cases that also means the hospital or clinic can collect payment at the point of care.

Healthcare has the classic situation of separate silos of data sitting within the health provider and insurance companies and the laborious process of needing to reconcile the two. Change Healthcare’s Product Development Director Emily Bailey explains a common occurrence: “A patient wants to know what they owe, and the provider [hospital or clinic] has a different number than their insurance plan. And that lack of clarity causes the patient to just wait until they can get the final answer.”

Not only does the patient’s delay impact the medical provider’s cash flow, but it also reduces the likelihood of recovering the money from the patient at all. By improving transparency so that all parties see the same data for the whole claims process, providers benefit from both earlier patient payments and from improved clarity about what they’ll get paid by insurers.

What’s in it for the insurers?

The blockchain benefits for the payers may seem less evident without looking at some of the more significant issues in U.S. healthcare.

A study published in the Journal of the American Medical Association found that 34% of the cost is wasted. At the time in 2011 that amounted to $910 billion. But between 2011 and 2017 U.S. healthcare spending ballooned by almost 30%. So based on 2017 costs the waste figure is nearly $1.2 trillion.

Given insurers are responsible for a large proportion of that spending, reducing waste could save many hundreds of billions, and the payers potentially have even more to gain than the other parties. Using blockchain to share data and reduce the need for reconciliations would be a big step towards addressing administrative complexity. That complexity accounts for 27% of total waste or the equivalent to $327 billion for 2017. But claims reconciliations are complex so that won’t be a short term win.

Bailey elaborated on another benefit: “One of the biggest, if not the biggest thing that insurance companies are concerned with is reducing their risk. And so to the extent that we can use this technology to prevent fraud, waste and abuse, that is a big impact to the payers.” The same waste study estimated the cost of fraud and abuse at $177 billion in 2011, equivalent to $230 billion for 2017 spending.

Abuse often happens when medical providers use a similar but inaccurate billing code because they know the alternative code has a higher likelihood of getting paid out. Automation with smart contracts has the potential to weed out this activity.

Another benefit to insurers is patient engagement. The vision is to provide patients with a digital identity and a wallet-like experience powered by blockchain. So patients will be able to see all the payments and medical events creating a more positive interaction with the insurer.

Technology partners

There’s a fourth type of participant in the blockchain ecosystem – the IT and software providers which provide services to the care providers and payers. These providers already integrate with Change Healthcare’s existing systems. Some are involved in clearing insurance claims while others provide billing and accounting software on top of the claims clearing infrastructure. Additionally, some electronic health record systems are integrated.

“There is an opportunity to engage those technology companies at the infrastructure level and provide a more peer-to-peer environment for the sharing of clearinghouse transaction data,” explained Bailey. “And they’re better equipped to actually distribute the network than a traditional payer or provider might be.” Even though some of the hospitals and insurers have significant technical teams, they are not in the network infrastructure business.

So there’s much to gain for each of the participants, but what about privacy?

Protecting private information

The blockchain system doesn’t include any protected health information, so there are no patient names or social security numbers. That’s all stored on a private network. The blockchain purely acts as a reference system. So it stores the claim id, timestamps, signatures and the 30 lifecycle events involved in a claim. Examples of events include claim received, claim rejected, or deferred.

APIs are used to access the blockchain. This enables end users to see the history of claim activity in chronological order, claim status and the reference number to documents stored off-chain. For those with the right permissions, they can then access the privately stored documents and protected health data but using an off-chain mechanism.

The technology used is Hyperledger Fabric, and the company’s CTO Aaron Symanski sits on the Hyperledger board.

For now, the entire network which launched a year ago is hosted by Change Healthcare on premises. And it’s running in parallel with the company’s core claims systems storing every claim life cycle event. Hence there’s the ability to turn on the blockchain in the background of the software and provide a seamless experience.

But the company is in the process of extending the network to a cloud-based blockchain to enable technology partners to join as peers.

Challenges and opportunities

However, for a large permissioned blockchain the biggest cost of cloud hosting is storage. Although the blockchain is capable of handling 30 million transactions a day, it quickly adds up to a significant volume of blockchain data to store. That may not be too expensive on premises, but it’s pricey in the cloud.

Hence Bailey explained, “we’re doing consulting to see of those 30 plus [claims] life cycle events, which ones really need to go on the blockchain versus which ones could be stored in a distributed database or some other environment.” An alternative solution being considered is to split up the transactions.

Beyond logging claims events, a more complex future step is auto-adjudication of claims. That will involve encapsulating some of the policy logic in a smart contract and standardizing some types of services so there can be rules about what treatments get reimbursed and under what circumstances. Getting that to work for even simple procedures is non-trivial.

Another important area is consumer experiences. Healthcare providers are currently custodians of medical data, and to prevent abuse many processes require patients to visit in person and do things in a paper-based fashion. Blockchain can help to track access to data and provide greater continuity of care for a patient as they access different health providers.

That’s the future. For now, Bailey believes the technology is still relatively immature, but to be at the forefront, it’s important to engage today. “Blockchain is an infrastructure technology, and the disruption is not going to happen overnight. It’s going to happen gradually,” said Bailey. “Where the transactions are a bit more simple and a bit more predictable, we think the technology can be applied in a shorter timeline.”