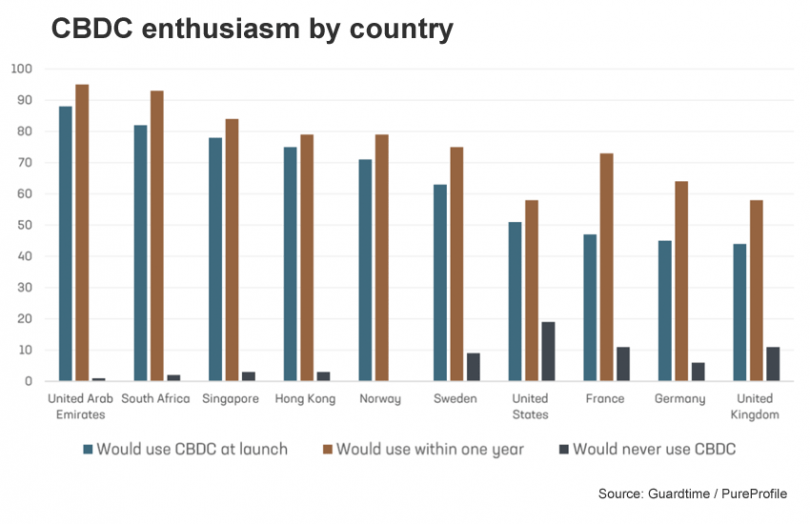

The Estonian blockchain company Guardtime has recently published a survey on consumer attitudes towards a central bank digital currency (CBDC). Across ten countries it found that 64% of consumers would be likely to use a digital currency at launch. Compared to other countries, the U.S. was more reticent, with almost 20% of respondents saying they would never use a CBDC.

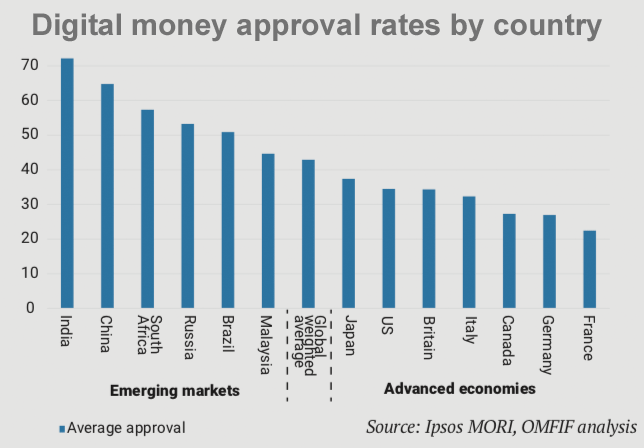

Until now, limited research has been conducted globally into whether consumers are ready and enthusiastic for a CBDC, despite a BIS survey finding that 86% of central banks are actively researching the potential for a digital currency. Apart from think tank OMFIF’s early 2020 report that involved IPSOS/Mori questioning more than 13,000 people, Guardtime’s survey is one of the first global consumer studies in this area. PureProfile questioned over 900 people in July 2021.

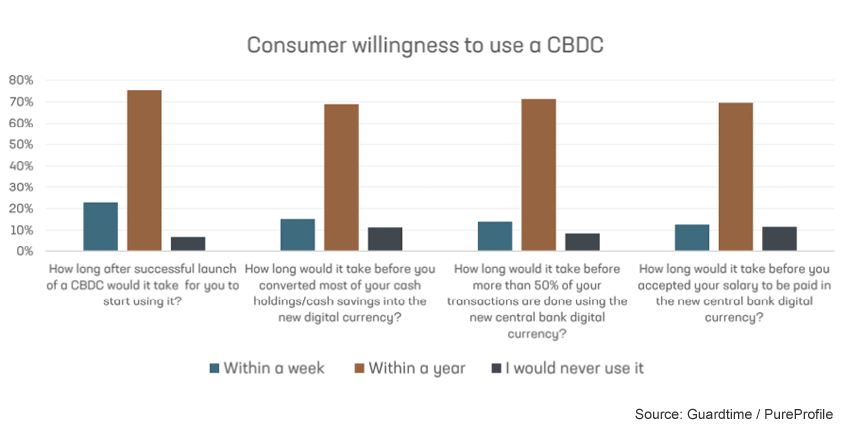

The survey found a “broad, global willingness to use a digital currency”. Across four use cases, around 70% of people said they would adopt a CBDC within a year, with slightly more enthusiasm for using a CBDC for payment as opposed to switching away from cash savings or accepting a salary in CBDC.

The survey asked consumers to rank the most important CBDC attributes, the top three being privacy, ease of use and no additional costs. This is fairly consistent with a recent European Central Bank survey that found the top desirable characteristics to be privacy, security and no additional costs. When it came to security, Guardtime asked whether a CBDC needed to be more secure than other digital payments, which only ranked 7th in importance.

It also seems that advanced economies are less enthusiastic about a CBDC than developing countries. This was also borne out by the OMFIF survey, which found greater enthusiasm for digital money in general, including CBDC and private digital currencies.

Guardtime is an Estonian technology company that has worked with the Estonian government for many years, including most recently on its CBDC tests for a digital Euro. It also has government contracts internationally. The company is known for its KSI enterprise blockchain, which has been deployed in high profile applications, including Insurwave, a joint venture with EY for international maritime insurance, with Maersk as the first client.