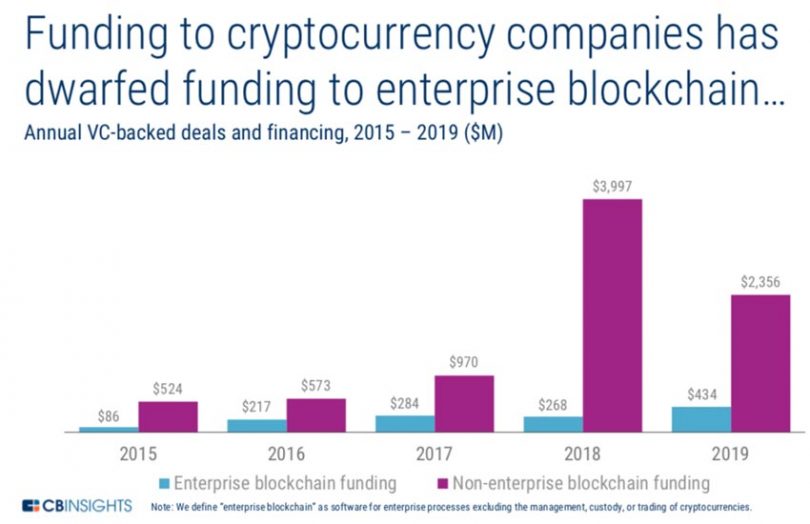

CB Insights recently published its 2020 Blockchain Report. In 2019 venture capital funding for enterprise blockchain firms was $434 million versus $2,356 million for cryptocurrency startups. The enterprise amount includes $200 million raised by Ripple.

On the one hand, there’s no question that when it comes to pure startups, cryptocurrency is attracting more venture capital funding. Its figures are distorted by two massive ICOs of $4 billion for EOS and $1.7 billion for Telegram.

However, much of the money invested in enterprise blockchain does not come from venture capital.

Firstly, major consultancies such as IBM and Accenture are developing enterprise blockchain solutions for their clients. Last year IDC predicted 2019 enterprise blockchain spending at $2.9 billion.

Secondly, there are numerous high profile consortia that have created new ventures. These invariably are funded by enterprises, not venture capital and the investment is only transparent in a few cases. An example is insurance firm B3i backed by 18 global insurers, which raised more than $22 million last year.

Thirdly, enterprise blockchain startup R3 had a massive windfall from settling its litigation with Ripple. That settlement replaced a potentially substantial venture capital funding. While the figure is not public, the amount of XRP tokens paid across is likely north of $200 million and quite possibly significantly more based on R3’s ongoing expansion.

And finally, cryptocurrency initiatives use some of the funds raised to incentivize open source developers. In contrast, many contributors to enterprise blockchain open-source initiatives are employed by major enterprises. This is especially the case for Hyperledger. And many big technology companies are investing in their own solutions such as VMWare in the U.S. and Ant Financial and Tencent in Asia.

In some cases, the lines between enterprise blockchain and cryptocurrency are blurred. An example is lending and asset-backed securitization firm Figure. The company runs the Provenance blockchain that recently securitized $149 million in loans. The firm also works with other mainstream lenders. It raised a $103 million Series C from crypto venture capitalists but also the likes of MUFG.

We would consider three of the big deals that CB Insights highlights as enterprise blockchain. They include Ripple’s $200 million, Figure’s $103 million and Fnality’s $63 million. With CB Insights’ total figure of $434 million, that only leaves $68 million for all other deals. That has to cover the more than $22 million for B3i, the $15 million invested by three oil majors in VAKT and numerous other transactions.

The first quarter of 2020 started well for enterprise blockchain. The big agribusiness firms formally created Covantis, and the trade finance consortium Voltron has now incorporated as Contour. Neither have published funding figures.

Given the COVID-19 Crisis, the big question is what the rest of 2020 holds for enterprise blockchain investment.