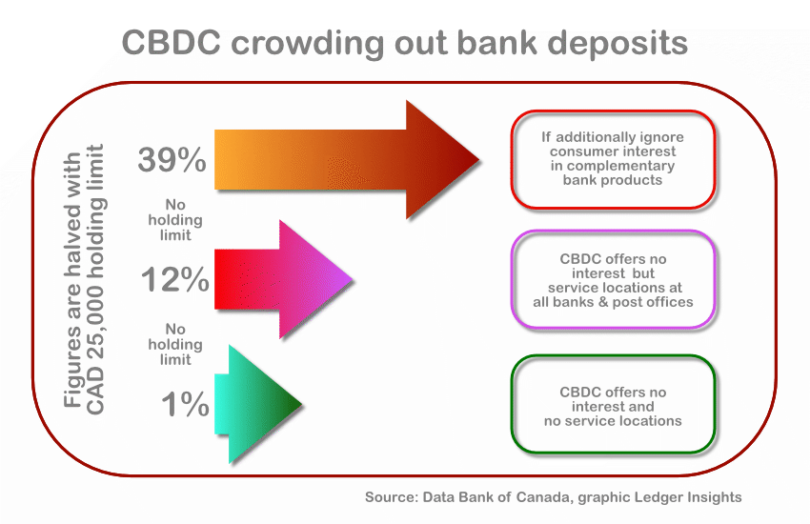

Economists at the Bank of Canada ran a model to assess the impact of introducing a retail central bank digital currency (CBDC) on bank deposits. It’s widely expected that a proportion of bank deposits will switch to a CBDC. The economists believe that most assessments neglect the fact that banks provide products that complement deposits, such as mortgages and credit cards. If you assume consumers don’t care about the other products their bank offers, then 39% of deposits could be crowded out by CBDC.

However, CBDCs are not perfect substitutes for bank deposits. So, if you consider consumer affinity for other bank products, the Canadian model estimates that just 12% of deposits would switch to CBDC. They based their data on a 2010-2017 household survey. It showed 56% of deposit holders had a mortgage from the same bank, and 45% had a bank credit card. The study assumes the CBDC does not offer interest.

An additional factor from the survey is consumer affinity for bank branch visits for customer service, support and complaints. Hence, they included this in the model as well. If a CBDC had no service points, they estimate the volume of deposits switching to CBDC would be just 1%. However, that wouldn’t be an ideal scenario. So, the 12% figure assumes consumers can get support for a CBDC at all banks and post offices.

CBDC holding limits

Another area explored was limits on the amount of CBDC consumers can hold. With a CAD 25,000 ($18,500) holding limit, the economists estimate that deposit switching to CBDC would be halved. They only expect this to impact 10% of households, but this group tends to have a large amount of liquid assets.

Each jurisdiction is adopting a different approach to holding limits. For example, China and Russia are opting to roll out their offerings gradually without limits. In contrast, the European Union proposes a €3,000 ($3,234) holding limit. However, EU banks are pushing for it to go down to €500. They argue a higher limit would reduce GDP. The UK is planning holding limits of £10,000 – £20,000 ($25,260), but in a recent consultation, banks want to see £3,000 – £5,000.