Chea Serey, the Governor of the Bank of Cambodia, has inked numerous deals to enable cross border payments with Bakong, the country’s digital currency payment system. This month it signed deals with three Korean banks to help migrant workers remit funds home. In an interview with the Nikkei, the central bank governor emphasized the move is part of a strategy to encourage the use of the local currency, the riel, in an economy where more than 80% of transactions use U.S. dollars.

In 2020 the National Bank of Cambodia launched its Bakong tokenized currency payment system. While it was initially heralded as the first live central bank digital currency (CBDC), it’s closer to being a tokenized deposit system using central bank infrastructure. The Bakong app links to both riel and dollar bank balances, although users don’t need a bank account.

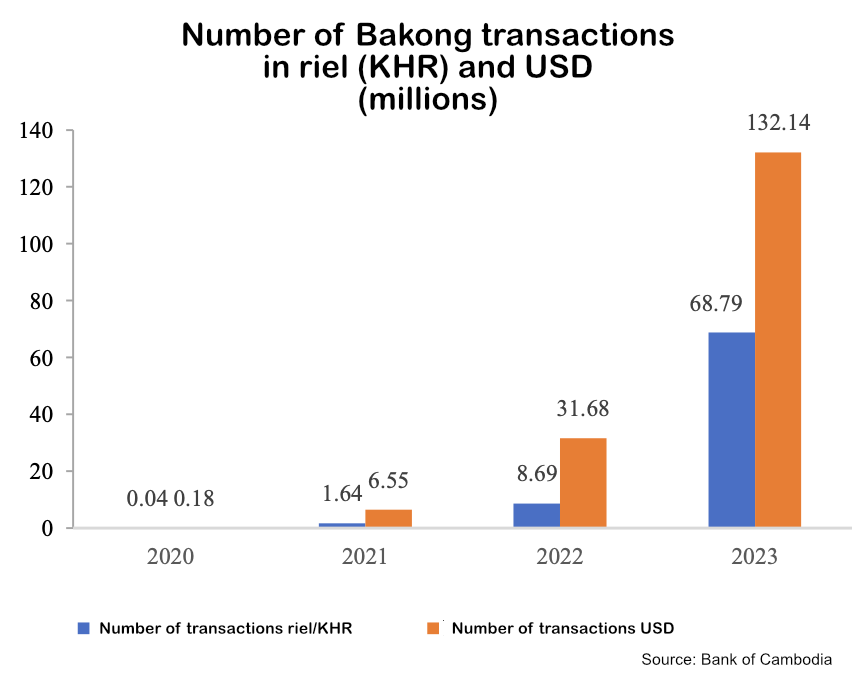

Bakong has been a huge success, with ten million wallets out of a population of 17 million and $70 billion in transactions since launch.

Numerous cross border payment linkages

Existing Bakong cross border arrangements include those with Malaysia, Laos, Thailand, Vietnam and China’s UnionPay and Alipay+. However, remittances can only be made in Khmer riel and not in U.S. dollars. Hence, on the Bakong platform, the proportion of riel transactions (around a third) is higher compared to cash, which is precisely Governor Serey’s strategy.

Cambodia also has a deal with India for cross-border payments, which is expected to launch in June. Bakong’s developer, Soramitsu, is leading a more elaborate digital currency arrangement with Japan. In fact, the Soramitus initiative looks to use Cambodia as a gateway for Japanese e-commerce firms that target the rest of the ASEAN.

Meanwhile, with a higher usage of the local currency, the central bank could have a greater influence over monetary policy. Currently it’s at the mercy of the U.S. economy, with high dollar lending rates impacting domestic lending. The central bank is trying to encourage lending using the local currency.

While many dollarized economies have volatile exchange rates, Cambodia’s has been relatively steady for the past 20 years or more. Hence, the ambition to de-dollarize isn’t impractical.